The accountable care organization (ACO) has earned itself something of a bad reputation in certain corners of the skilled nursing world, but leaders who read SNN revealed an increasing willingness to work with the groups — instead of getting left behind.

That’s just one of the many takeaways from our annual reader survey, which SNN conducted in December 2019 as a way to identify the top sources of concern and opportunity leaders saw ahead for the coming year.

We’re highlighting the top three trends that our survey respondents predicted for the coming 12 months, but be sure to download the report to see the full set of results — and where your organization stacks up against the crowd.

ACO accolades

When asked to share their top strategies for success in 2020, the largest number of respondents picked “deepening relationships with ACOs” — by far the most popular response to the question, accounting for about 40% of answers. In fact, ACOs placed far ahead of other buzzy moves such as investing in specialty services or launching an Institutional Special Needs Plan (I-SNP), a provider-led Medicare Advantage model.

ACOs seek to reduce Medicare spending by holding providers up and down the continuum accountable for episodic costs. Skilled nursing operators have frequently claimed that the model encourages reductions in institutional post-acute care utilization, as SNFs and other brick-and-mortar rehab settings generally cost more than home health services — with one anonymous provider telling SNN earlier this year that the growth of ACOs has been “a disaster” for the sector.

But SNFs and ACOs don’t have to be enemies. Skilled nursing giant Genesis HealthCare (NYSE: GEN) has made the growth of its accountable care organization — known as the LTC ACO — a key part of its 2020 growth strategy, with a particular focus on attracting providers from outside its own network.

LTC ACO earlier this month announced a new partnership with the 37-building Senior Living Properties skilled nursing and long-term care chain, a gain that comes on top of the nearly 200 non-affiliated care sites that the ACO added by the end of December.

Private equity primacy

Data firm Preqin kicked off 2020 with a staggering statistic about private equity: Non-public firms are currently sitting on $1.5 trillion in available capital, a record high that’s double the figure from just five years ago.

While that number covers potential investors in everything from tech to textiles, private equity’s appetite for long-term and post-acute care facilities is well-documented, and SNN readers expect this class of investors to top the ranks of buyers in 2020.

Between private equity investors and privately held real estate investments trusts (REITs), non-public investors accounted for 63% of potential skilled nursing facility buyers in 2020, at least according to SNN’s group of survey respondents.

These results echo those of global consulting firm PwC, which earlier this month honed in on private equity’s power to drive health care mergers-and-acquisitions growth over the coming 12 months.

“On the sector trend front, capital availability persists and will continue driving deals activity,” PwC observed. “Private equity firms, for example, are likely to continue seeking value-driven models, especially in growing sub-specialties. Private equity firms also remain potential deals partners for payers and providers.”

But that doesn’t mean that more traditional sources of skilled nursing financing will be left out in the cold in 2020. When asked for the top sources of cash, a full 51% of respondents selected the old reliable bank or financing company, with only 34% saying private equity was their top choice.

And even though private equity firms are well-capitalized, the path may not necessarily be easy for all interested investors. All of that interest in nursing homes and other care sites has drawn the attention of Congress, which could increase regulatory scrutiny in private companies’ long-term care dealings — especially if the November election brings a significant sea change to Washington.

PDPM woes fade

Fears over the impact of the Patient-Driven Payment Model (PDPM) for Medicare reimbursement dominated the headlines in 2019, but with nearly four full months in the books, concerns over PDPM’s effects have begun to wane.

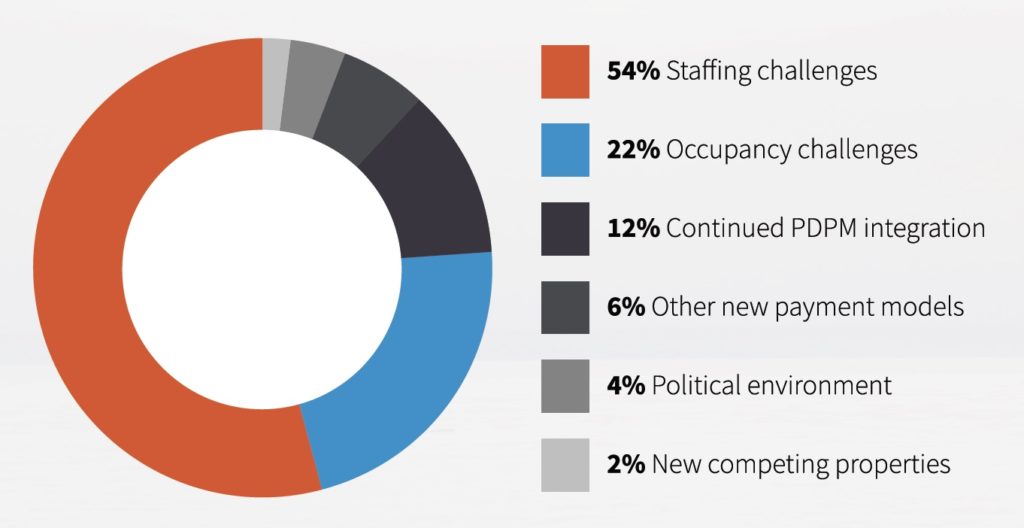

When asked to identify the primary challenge of 2020, just 12% picked continued PDPM integration issues, with staffing (54%) and occupancy (22%) problems closer to the top of our respondents’ minds.

Of course, that doesn’t mean that the new model — which shifted payment incentives for therapy services away from volume and toward resident need — didn’t prompt changes in strategy over the year. [

Increasing the use of group and concurrent therapy — a primary source of cost savings under PDPM — and attracting higher-acuity residents emerged as the most popular moves, according to our survey respondents, who were allowed to choose as many of the below options as applied to their operations. Interestingly, layoffs fell toward the bottom of the list, despite an earlier SNN poll that showed 43% of operators had laid off some amount of employees in the wake of the payment shift.

The industry seems to have entered a period of cautious optimism around PDPM, though early returns showing more reimbursement winners than losers have raised the specter of potential clawbacks or downward adjustments from the Centers for Medicare & Medicaid Services (CMS) over the coming months.

That said, it’s important to remember that PDPM only affects traditional fee-for-service Medicare payments, a shrinking part of each building’s overall revenue as Medicare Advantage and other payers continue to eat up a greater share of resident days.

The most recent analysis of PDPM payments showed about 67% of facilities achieving payment bumps in November 2019, the model’s second month, though its author emphasized that falling lengths of stay could cut into any short-term gains.

“If they had the same amount of covered days, then they’re going to have 5.27% more revenue,” Zimmet Healthcare Services Group president Marc Zimmet told SNN. “But there’s a difference between average rate and aggregate revenue.”