The latest analysis of the new Medicare payment model for nursing homes again shows more operators scoring gains than suffering losses, but the change from the previous system may not be quite as straightforward — particularly as fee-for-service Medicare continues to lose ground to other payment sources.

A little more than 67% of skilled nursing facilities saw some kind of per-diem Medicare payment increase this past November, according to the latest analysis from Zimmet Healthcare Services Group and its affiliated data firm, CORE Analytics. That’s compared to 32.6% of buildings that experienced daily-rate drops in the second month of the new Patient-Driven Payment Model (PDPM) for nursing facilities.

The new analysis, released Wednesday, uses a different benchmark from Zimmet’s previous PDPM report, which compared per-day rate performance between the new payment model and the old Resource Utilization Group, Version IV (RUG-IV) system — and showed about 91.5% of operators scoring gains in October.

For the second round of analysis, Zimmet and CORE compared actual November performance against the Centers for Medicare & Medicaid Services’ (CMS) own 2017 PDPM benchmark projections, which predicted a vastly different outcome. Under CMS’s initial estimate, only 31.4% of facilities would pull down rate boosts, while 68.6% would see some kind of per-diem rate reduction — or essentially the reverse of what Zimmet’s real-world numbers showed.

The report used payment data from 859 facilities within CORE’s database, representing providers in 38 states and Washington, D.C. — though the companies took pains to emphasize that the sampling isn’t scientific and shouldn’t necessarily be used to reflect national performance.

On an overall basis, CMS expected the average Medicare rate for the cohort of facilities to drop by 1.37% per patient day in its initial 2017-based assessment; in Zimmet’s analysis, the group logged an aggregate average gain of 3.9% in November, with PDPM average daily rates running 5.27% above the CMS projection.

The Morganville, N.J.-based reimbursement consulting firm isn’t alone in its assessment of increased Medicare rates under PDPM. Just last week, a partner at consulting firm BKD noted that “generally everyone” has achieved some kind of revenue boost in PDPM’s first three months, and American Health Care Association president and CEO Mark Parkinson told SNN earlier this month that PDPM was running “probably a little bit above budget-neutral.”

PDPM’s intended budget neutrality has emerged as an area of concern in 2020, as CMS could take steps to either claw back reimbursements or implement downward adjustments in future payment rules if officials determine that the industry has made too much money off of the system.

After all, CMS explicitly introduced the model as a way to combat what it characterized as improper spending on unnecessary therapy services — and Zimmet Healthcare president Marc Zimmet himself predicted a correction before the year is out in SNN’s annual 2020 executive outlook.

But Zimmet told SNN on Wednesday that the latest round of data proves that determining PDPM’s budget neutrality, or lack thereof, is difficult — particularly because CMS’s own 2017 benchmark data reflects a bygone skilled nursing payment landscape that has since seen rapid growth in alternate models.

“How is CMS going to measure budget-neutral?” Zimmet said. “If it’s predicated on that model in 2017, it’s a different world.”

The latest report specifically zeroes in on how declines in length of stay could potentially erase any benefits from higher per-day payments.

“Many of CORE’s providers reported significantly more distressing declines,” Zimmet and CORE noted in their report. “Specific to CORE contributors with rates above CMS projections, covered days are below baseline at over half of the facilities. Thus, despite the positive rate effect, aggregate revenue would continue to dissipate as the FFS population atrophies.”

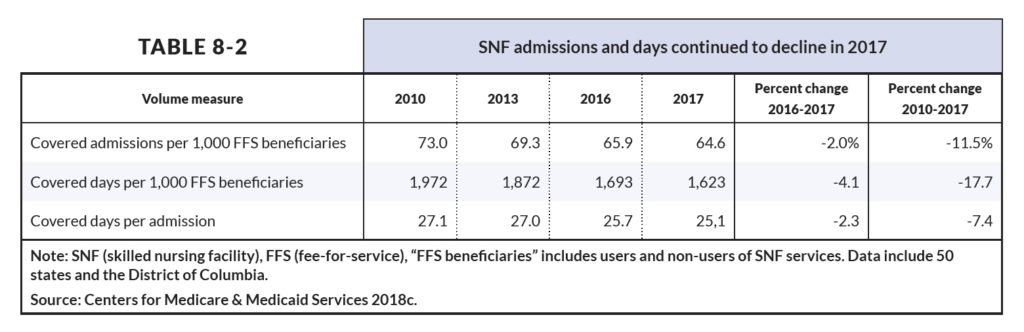

CMS data shows a 17.7% decline in fee-for-service days since 2010, as well as a 7.4% drop in covered days per skilled nursing admission.

This trend — along with the rise of Medicare Advantage, which provides lower-per day reimbursements for nursing home services — complicates the question of whether PDPM is achieving the goal of fairly compensating operators for providing appropriate care, without raising or lowering overall Medicare spending.

In other words, while PDPM may be a short-term boon for operators on a per-day basis, the Zimmet report posits that the old familiar headwinds could blow all of those gains away.

“If they had the same amount of covered days, then they’re going to have 5.27% more revenue,” Zimmet told SNN. “But there’s a difference between average rate and aggregate revenue.”

The analysis gives the real-world example of an accountable care organization (ACO) and a SNF that had worked together to improve resident outcomes while also shortening lengths of stay. The skilled nursing operator invested substantial amounts of time and money in the initiative, decreasing the length of stay for the ACO-covered residents from 27 days to to 18. But the ACO pushed harder, implementing a remote-monitoring system designed to shave four more days off the length of stay.

In return, according to Zimmet, the SNF asked for a plum spot in the ACO’s referral network in order to help mitigate the drop in fee-for-service Medicare days; the ACO responded by pointing out that the property had seen a nearly $200-per-day FFS reimbursement gain under PDPM.

“Care is improving, outcomes are generally positive, and program savings are realized,” Zimmet wrote. “But where does this leave our SNF? The bottom line is that this high-quality provider faces growing financial pressure on multiple fronts.”

As the industry looks ahead to potential adjustments and corrections from CMS, Zimmet called on leaders to use a common language when discussing the changes in payment, one that acknowledges that PDPM is only one part of a building’s overall reimbursement equation.

“As an industry, we need to develop a consistent measure to weigh against,” he said. “Everybody talks about PDPM performance — you have to have qualifying factors there. If your rate goes up, with a short length of stay, are you doing better?”

Component breakdown

In Zimmet’s first PDPM analysis, the firm pointed out that early claims data contained evidence of “impossible combinations,” or mistakes in accurately capturing diagnoses that led to operators leaving money on the table.

That trend, prominent within the speech language pathology (SLP) domain, continued into November: Despite a drop in Medicare residents without a reported swallowing disorder or mechanically altered diet, Zimmet’s analysis revealed that some operators may still be missing some payment opportunities.

“These two conditions raise the Component rate, but many patients scored with ‘neither’ had speech therapy charges reported on the UB-04,” the firm pointed out. “This gets technical, but implies PDPM SLP drivers are present and treated, but not captured for payment.”

The analysis also determined very little change in reimbursements for physical and occupational therapy, with only a $1 shift from October to November and no real substantive differences in PT and OT rates among the four new payment categories.

“Ironically, this is PDPM’s greatest flaw; paying similar rates irrespective of patient-specific condition strangely perpetuates a practice the system was intended to eliminate,” the company observed.

Companies featured in this article:

American Health Care Association, BKD, Centers for Medicare & Medicaid Services, CORE Analytics, Zimmet Healthcare Services Group