Skilled nursing market activity continues to be robust despite regulatory tailwinds creating a potentially uncertain future for operators.

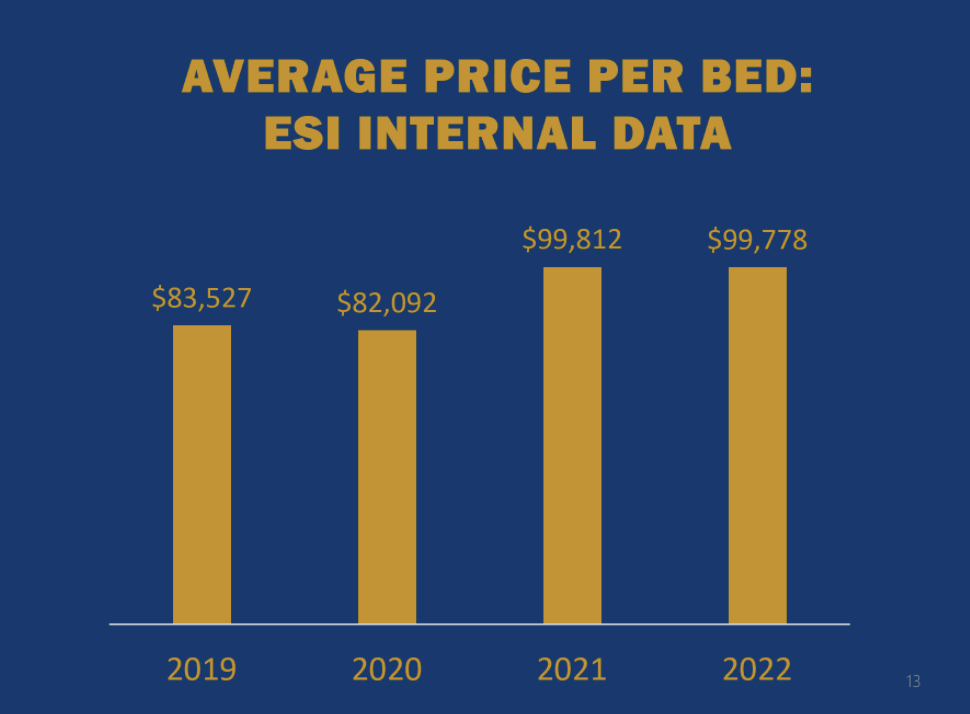

Last August price per bed valuations were up $17,000 compared to 2020 for the skilled nursing industry, according to seniors housing and SNF brokerage Evans Senior Investments, and valuations have largely stayed at those levels so far in 2022.

“We’re as busy as we’ve ever been in 20 years,” ESI President and Founder Jason Stroiman said during a webinar held this week on the industry’s M&A activity. “There’s so much activity out there and so many new buyers every day coming into the marketplace.”

In New England and in other “very attractive” regions of the country, ESI has closed deals that reached more than $200,000 per bed.

“In more rural areas we’re seeing prices below $90,000 a bed,” Stroiman said.

While the Biden administration has pointed to private equity firms as the ones “buying up” struggling nursing homes, Stroiman said the most aggressive buyers have been fairly newer organizations to the industry, with anywhere between 10 to 40 facilities. Those operators can be aggressive with pricing because they have ancillary businesses to add, he added.

“If they have their own pharmacy or they have their own therapy company, it allows them to push more revenue under the master umbrella and it makes the economics that much more attractive to be able to pay these aggressive pricing,” he explained.

The difference between the management fee, which is standardized at 5%, and 1.5% or 2% it actually costs to run these facilities is extremely “accretive” when underwriting facilities as a buyer.

“That is the dirty secret on how [certain buyers] are getting from a 73% occupied building to a pro forma value as if the building is stabilized,” he said. “I think a lot of people don’t appreciate the price that these buyers are willing to pay despite the current performance.”

Occupancy recovery across the country continues to be “uneven” as some operators have reached up to 80%, while the national average is around 73%, according to Stroiman.

He added that the next four to nine months will be a “crucial window” to see if the market will keep this pace from a mergers and acquisitions perspective.

Regulatory tailwinds make tough situation even tougher for SNFs

From a macro perspective, with rising inflation, staffing issues and potential regulatory changes, there has never been more pressure on the SNF industry, according to ESI Director of Valuationas Kristopher Lowes.

So far this year 20 nursing homes have reportedly closed, but the American Health Care Association (AHCA) projects that number could reach more than 400 by the end of the year.

Lowes said staffing agency pricing continues to plague operators.

“We’ve seen some relief recently but it’s still an area where if you’re using agency staffing in any meaningful way, the profitability of your community is going to be severely downgraded,” he said.

Still, his expectation is that the Biden administration will move forward on several of the proposals it laid out in its nursing home reform package — including pursuing better financial transparency and higher minimum staffing standards.

“Everything I’ve seen after that speech, they’re very serious about following through with that so expect that to be rolled out at some point,” he said.

It might not be the “appropriate time” to implement such measures, according to Lowes.

“Probably the biggest kick in the teeth to the industry is just the potential for survey penalties to go from $21,000 to a million dollars,” he said.