Symphony Post Acute Network has helped redefine the skilled nursing, transitional care business—so much so, some other providers in Symphony’s markets are banding together to stay competitive. But what exactly does Symphony’s model involve?

It’s a mixture of elements that together create a “super SNF,” Symphony President Tim Fields said Tuesday at the Post Acute Link Care Continuum Conference in Chicago. Symphony is based in the Windy City, and the Chicago area is the largest market for the company, which pulls in about $400 million in revenue annually.

The “super SNF” model, also known as a medical resort, combines medically complex care with high-end hospitality. It’s not a brand-new idea; Symphony and one of its development partners, Carmel, Indiana-based Mainstreet, have been among a few organizations to pioneer and go big on this type of facility over the past several years.

However, the super SNF is still a relatively novel concept, and those interested in the model might want to take some cues from what Symphony has done in a few key areas:

1. Staffing: The super SNF is something between a traditional skilled nursing facility and an inpatient rehabilitation facility or long-term acute care hospital. Non-invasive vents, low-dose inotropic drips, wound vacs, IV antibiotics/Lasix, and dialysis are among the services that might be offered. In addition, the business model rests on a high velocity of 100-plus admissions a month from a variety of settings, with a premium on short length of stay and high-quality outcomes to hit expectations of managed care organizations and similar referral partners.

It’s critical to hire staff that can handle and even relish this level of acuity and intensity, Fields said. Symphony gets the wage grids from area hospitals and matches registered nurse compensation dollar-for-dollar. Fields’ ambition was to hire RNs exclusively, but this turned out to be unrealistic in some markets where the labor pool is not so deep. Still, hiring more RNs than licensed practical nurses (LPNs) is important, with a 10:1 to 12:1 nurse/guest ratio.

Physician oversight also is crucial, with the leaders involved in weekly admission reviews, fall/wound/infection control, and quality assurance performance and improvement (QAPI). Symphony has negotiated with some of its hospital partners to designate a hospitalist to act as a SNFist, Fields said.

2. Clinical Programming: “Heart for Life Cardiac Program.” “Breathe Easy, Live Well Pulmonary Program.” “WoundRounds.”

These are just a few of the clinical programs Symphony has branded, to stand out in the marketplace.

“I think [branding] matters when we talk about doing something different,” Fields said.

Of course, clinical care is about more than creating a recognizable brand name, so these programs must be rooted in evidence-based protocols, Fields emphasized. Partner with local cardiologists, pulmonologists, nephrologists, and other specialists, he advised, and utilize tools like INTERACT to create a culture of clinical excellence.

3. Data Analytics: Being able to track data such as hospitalization rates is becoming table stakes for skilled nursing providers in an increasingly integrated health care marketplace, in which they’re being asked to demonstrate their value to hospitals and other referral partners.

Symphony also is implementing analytics tools such as Real Time Medical Solutions, which integrates with and scours the PointClickCare electronic medical record for information in order to flag particular patients for attention.

Another initiative is EMMI, an engagement tool for CHF and pulmonary patients, who are now getting a call every day for 45 days after discharge, in an effort to prevent hospitalizations during this timeframe. The data on this effort still is forthcoming, Fields said.

4. Guest Experience: Providing a top-flight guest experience is one of the hallmarks of a super SNF, Fields emphasized. Just as Symphony tries to lure its clinical staff away from hospitals and IRFs, it hires its hospitality staff from hotels and other customer-first industries. About 60% to 70% of Symphony buildings now employ an executive chef.

“We hired a lot from Chicago hotels, hotel concierges, and we’ve found Starbucks does a really good job training people,” Fields said.

The hospitality model is achieved through the physical plant, with a focus on private rooms and amenities like Starbucks cafes. But service with a personalized focus also is critical. Prior to admission, Symphony asks each guest to share their favorite food and drink, and one thing they miss from home, then has these things waiting in the person’s room at arrival.

“Something as simple as, ‘I miss Diet Coke and sudoku puzzles,’” Fields said. “When they admit to the building, that’s sitting on the bedside table. It’s a good first impression.”

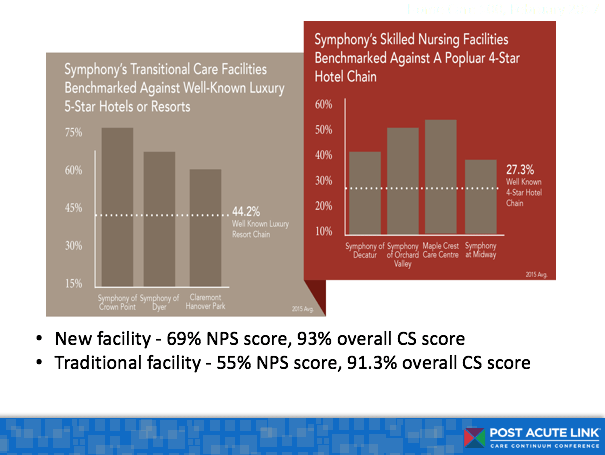

The approach helps Symphony achieve high net promoter scores (NPS), which measures how likely a guest is to recommend Symphony to a family member or friend. Ritz-Carlton, one of the gold-standard hotel chains on this measure, has a 68.2 average NPS. A new Symphony building in Indiana has achieved a 69, Fields said.

As these best practices show, the Symphony model is demanding on an operator, but the payoff also can be substantial.

On the clinical side, for example, Symphony super SNF communities average a four- to five-star rating from the Centers for Medicare & Medicaid Services (CMS), Fields shared. In terms of financials, it’s possible to run EBITDARM margins of 20% or higher on super SNFs, he said.

Symphony is not immune to challenges felt across the sector, such as tight labor markets, Fields acknowledged to Skilled Nursing News. Still, he is firm in his belief that the super SNF is a strong operational model for the evolving health care system.

“I think it’s a great place to be,” he said.

Written by Tim Mullaney