Identifying the difference between nursing home landlords, lenders and operators, and even setting new requirements for each, may help ensure profits better match quality in the space moving forward.

That’s the argument being put forward by some academic researchers who have focused on nursing home ownership structures. And their arguments are helping to inform federal policy, as the White House’s proposed nursing home reforms include several provisions on private equity ownership and transparency.

Dr. Atul Gupta, an associate professor at Wharton, has found that understanding ownership arrangements for nursing homes is like navigating a “maze.”

“Literally we spent six months trying to identify which nursing homes were bought by which private equity firm,” he said during a conference on the effects of private equity on health, hosted by Drexel University. “It’s quite difficult to observe private equity ownership.”

He recently co-authored a study about private equity in nursing homes. Using administrative data from the Centers for Medicare & Medicaid Services from 2004 to 2016, he found that around 1,700 nursing homes were bought by private equity firms over that 12-year span.

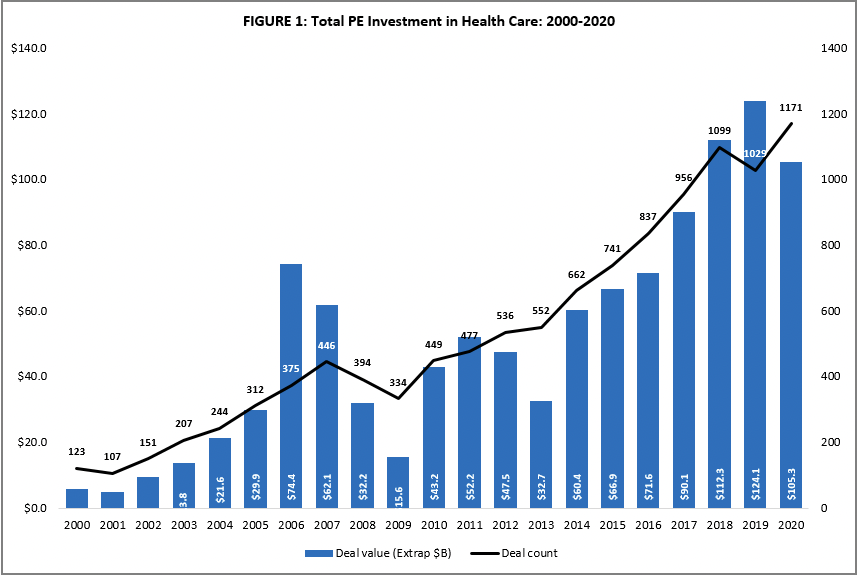

Rosemary Batt, a Cornell University professor, said in a separate panel during the conference that private equity investment in health care has increased 25-fold since 2000.

She’s observed the growth of private equity in health care over many years as deal volumes reached $105.3 billion over 1,171 deals in 2020 compared to 449 deals for $43.2B in 2010.

She said that private equity drives the “financialization” and restructuring of health care, turning it from a social good into a financial commodity to be bought and sold.

Private equity structure

The role of private equity firms in the post-acute and long-term care landscape came under intense national scrutiny in recent years even before the release of the nursing home reform. A group of Democratic federal lawmakers — including Sen. Elizabeth Warren of Massachusetts — sent letters in 2019 to four PE companies with nursing home holdings, demanding detailed information about their properties and revenues from government payers prior to the pandemic.

Scott Bardowell, a consultant in the health care industry in risk management, said during the conference that there can be a number of benefits of being a non-operating landlord, which is often the case with private equity firms and REITS. These benefits include avoidance of liability, penalties from government regulators, avoidance of capital expenditure investment into the property and more.

Unlike traditional for-profit owners who may want to retain control indefinitely, private equity firms make most of their profit when they sell their stake, hence, monetizing assets early may make more sense for a private equity firm but may not for a long-term owner, Gupta explained.

In some cases, a private equity firm can still make money on an investment even if the target firm goes bankrupt.

“I know that CMS, through their five-star ratings, are trying to make the nursing home owners care about quality, but I think that more can be done to align their incentives with the incentives of patients and taxpayers,” Gupta said.

Gupta found private equity has “substantially higher” mortality rates, at 15% higher, at the same time Medicare spends 10% more. Use of antipsychotics was also said to have increased.

“In the context of nursing homes, I think the evidence is relatively consistent that for-profit ownership tends to produce lower quality outcomes for patients than nonprofit ownership,” he said.

Charlene Harrington, a professor emeritus at the University of California-San Francisco, said during the conference that 70% of nursing homes are for profits, about 60% are chains and that a growing number are private equity-owned. She has repeatedly stressed the need for more research on the impact of private equity on the quality of care and was critical of its involvement in the space during last week’s conference.

Harrington wants to see more done to ensure that those that are making the most money off nursing homes are providing the best – or even adequate – care.

She wants to see an increase in ownership reporting for all private nursing home investors.

“Right now owners only have to report ownership with the operating nursing home, but not for the parent company, the property companies, management companies and all the other companies,” she said. “And we’d like to see much greater ownership oversight of chains rather than just the individual nursing home operating facility.”

Bardowell thinks one way to improve transparency could be through the landlord operator lease arrangement.

“The leases should have an addendum that essentially has the landlord taking some interest in providing the resources needed to establish an ethical culture and a truly vibrant ethics department lights department and training on quality of care,” he said.

In his research he found that there have been occasions with organizations overseas where they established certain provisions with investors, such as REITs, to support the operators and to meet expectations through their oversight of their properties, including contractual obligations in the leases, he explained.

“What they’re fighting for is understaffing, improving health and safety, improving wages and contracts, providing freedom of association and collective bargaining, and quality of care,” he said.

Industry counterpoints

Professionals in the industry have in recent weeks raised counterpoints to some of the arguments put forward at the Drexel conference and in other forums in the weeks since the White House released its reform proposals.

One critique: The nursing home reform package doesn’t distinguish between the various types of private ownership structures seen in the long-term care space.

“Clearly [the administration] doesn’t understand the difference between private equity, private capital and REITs. Years ago it was private equity that did the ManorCare deal and did the Genesis deal, but there’s actually almost no private equity in skilled nursing now,” Sabra Health Care REIT (Nasdaq: SBRA) CEO Rick Matros recently told SNN. “There is private capital, individual groups that have raised their own money to buy nursing homes.”

This was a point also raised last week by capital providers who participated in a Skilled Nursing News virtual panel on the investment landscape.

“The White House’s claims regarding private equity and Biden’s comments really just unfortunately show that some of the leaders in the country don’t really understand the dynamics of the industry,” said Jonathan Slusher, partner and head of senior living and health care at real estate private equity firm the Northwind Group.

Slusher and co-panelist Donika Schnell, managing director at real estate finance and investment company Greystone, also agreed that quality data can be skewed by the fact that private investors are more likely to acquire poorly-performing communities with the intention of achieving turnarounds.

Stifel analyst Tao Qiu said after the reform was announced that its focus on private equity didn’t reflect the market patterns seen in skilled nursing today.

“We haven’t seen any big major deals involving those larger private equity players in the skilled nursing space for quite some time,” he said. “So I don’t think private equity is rushing to the space.”

However, some skilled nursing industry leaders do believe that improving transparency and providing more clarity between the parent company that owns a nursing home and its operators could be beneficial.

Such rules could highlight differences between private equity and REIT ownership and create better frameworks for accountability on quality. However, industry insiders also caution that transparency rules should be carefully formulated, so as not to deter investment in the space, which is critical to supporting the growth of quality operators and meeting the needs of an aging population

Companies featured in this article:

Cornell University, Drexel University, University of California-San Francisco