As the road to recovery continues for the senior housing and care industry, a new survey from real estate giant CBRE, released this month, indicates significant investment growth in the short-term with a full recovery expected sometime in 2022.

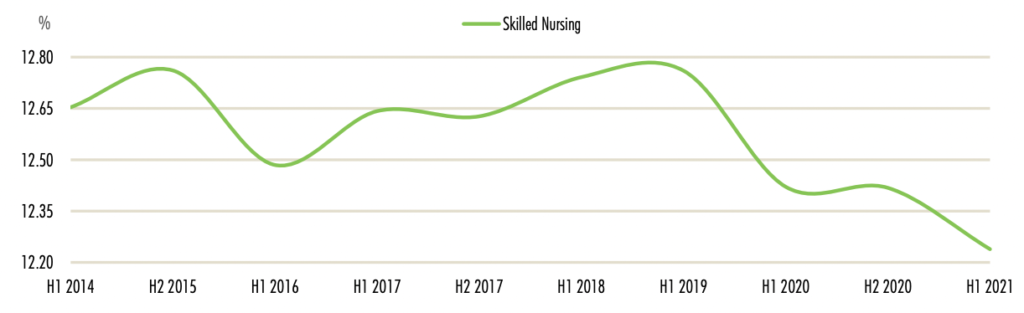

With the skilled nursing mergers-and-acquisitions market hotter than ever right now, summer cap rates for these facilities are on the decline as it saw the second largest compression compared to the second half of the year among all property types.

Cap rates for the most desirable, Class A nursing facilities in core locations averaged 10.9%, according to CBRE’s Summer 2021 Seniors Housing & Care Investor Survey — a figure that rose to 11.7% for Class B properties and 13.3% for Class C properties as the best assets are considered to have the lowest risk.

“Skilled nursing showed further compression after being the one with the most activity from investors the quickest during COVID,” James Graber, national practice leader of Seniors Housing & Healthcare for CBRE’s Valuation & Advisory Services, said in an interview with Skilled Nursing News. “They were definitely first back to market and I think that speaks to the depth of folks that are in that space that understand skilled nursing.”

While the SNF cap rate showed a slight increase from the first half of 2020 to the second half of 2020, that trend was quickly bucked with the market heating up. Cap rates share an inverse relationship with prices so as cap rates decrease, prices go up, as indicated in a recent outlook report released by Calabasas, Calif.-based real estate brokerage firm Marcus & Millichap.

Overall, the spread between core and non-core assets increased, representing a flight to quality for investors, CBRE observed in its analysis.

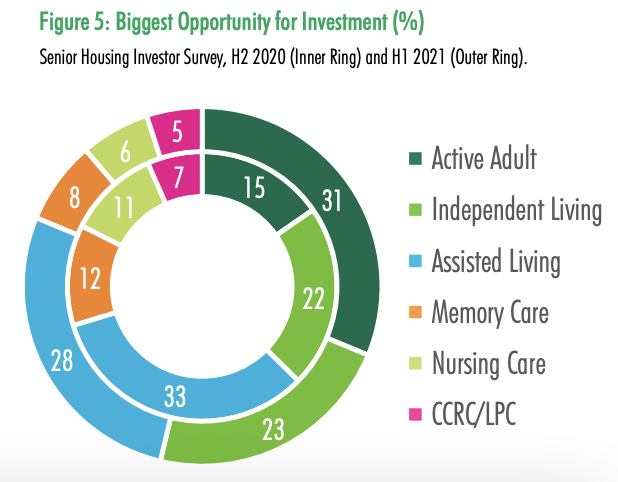

However, respondents still indicated less interest in investing in skilled nursing assets compared to other categories in senior housing and care, such as active adult and independent living facilities.

Both memory care and skilled nursing showed significant declines in investor perception of opportunity, as higher-acuity operations were considered to be riskier investments.

Only 6% of respondents wanted to invest in skilled nursing, down from 11% in the second half of last year.

Graber admitted that this may have to do more with the public perception surrounding SNFs at this time than buyers’ actual interest.

“I think that speaks to the investor pool being somewhat smaller for skilled nursing,” Graber said. “When you’re looking at an overall cross segment of the folks in this survey, not all are active in skilled nursing.”

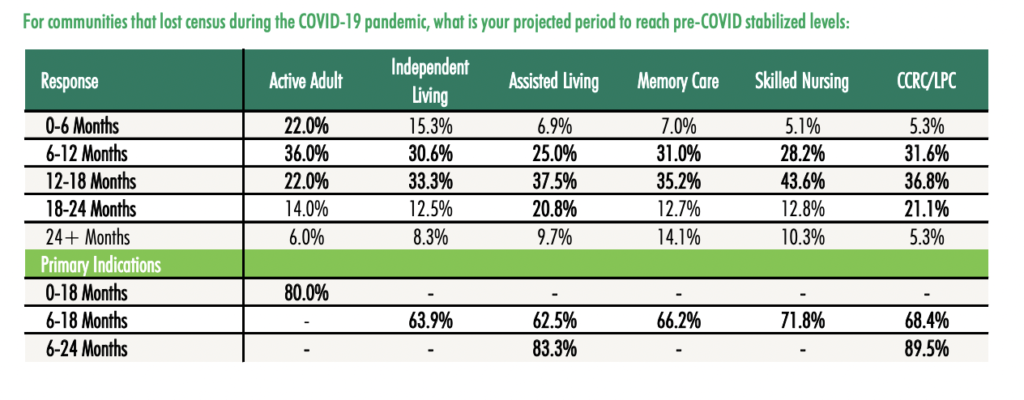

Outside of active adult, the skilled nursing sector was the most optimistic about the next 18 months, with nearly 44% of respondents expecting census levels to stabilize to pre-COVID levels some time in the next 12 to 18 months.

Just over 10% of respondents said it would take skilled nursing facilities 24 months or more to return to pre-COVID levels.

Graber felt that the return of elective surgeries, which were suspended during COVID, helped bolster SNF numbers.

“It will come back quicker than most care levels because it is the highest needs based,” he said.