The private sector has become more interested in investing in skilled nursing assets this past year into 2021, thanks to less competition from the public sector and (in some cases) distressed sales due to the pandemic.

Public skilled nursing facility (SNF) owners like LTC Properties, Welltower Inc. and Omega Healthcare, meanwhile, are less inclined to invest in the space compared to pre-pandemic years, sources have told Skilled Nursing News.

Instead, public real estate investment companies (REITs) like those have turned inward to restructure assets and better position themselves in the eyes of shareholders.

The trend has both positive and negative implications for SNF operators.

Magnified interest

The private sector’s newfound interest in SNFs is being driven by untapped opportunity, according to Laca Wong-Hammond, managing director of mergers and acquisitions at Lument in New York.

“If we take a step back and really assess why this sector is so attractive to private equity, the answer is simply in my mind an opportunity for returns,” Wong-Hammond told SNN.

Wong-Hammond focuses on senior housing and care properties at the commercial real estate firm. She cited more attractive risk-adjusted yields in the SNF space, significant leverage at favorable rates, a diverse payor landscape and long-term demographic changes as drivers for private investors.

“Aside from the distressed side of transactions, because of Medicaid and Medicare, there’s still some opportunity for investing in core premium operations,” Wong-Hammond said. “Whether you’re a distressed investor, a value player, or just looking for attractive risk-adjusted yield onto a premium core investment, skilled nursing offers a diversity of those opportunities.”

Distressed sales occur when a seller is rushing to rid itself of an asset to pay debts or avoid a business emergency, helping boost potential yields, Wong-Hammond explained.

For some operators, private investors may be their best option at this point in the pandemic, JLL’s Brian Chandler told SNN.

Chandler serves as managing director of valuation and advisory services out of the commercial real estate firm’s Dallas office.

“They can get immediate capital infusion to help improve their physical plant and their operations,” Chandler said. “There’s a flip side to this, as well, because some of the PE firms … want to maximize their profits and investment yields. … This could add more debt to the facilities and potentially reduce staffing.”

However, the JLL director added that private equity (PE) firms have been able to leverage financial resources faster than they normally would pre-pandemic, improving operations and avoiding more COVID outbreaks.

Less competition

While PE players have their strengths, public entities usually have more arrows in their quiver in terms of financing options, according to Wong-Hammond.

“Usually when [public players] are interested, they will end up submitting a very aggressive bid, and unless private equity does want to pay up for an acquisition, they might get beat out,” explained Wong-Hammond. “I think they’re taking advantage of that now, as they should.”

Public owners generally removed themselves from the bidding wars to focus on internal restructuring, a shift from pre-pandemic play.

Other sources have told SNN that less competition from REITs translates to more ambitious and creative acquisitions for those in the private sector.

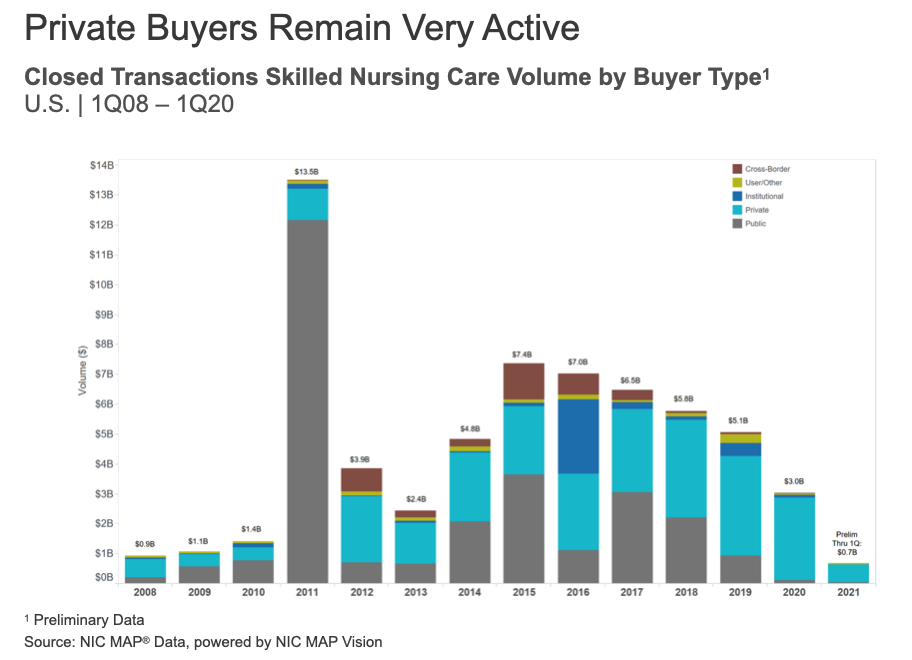

Private capital investment in nursing homes made up a whopping 91% of total investment volume so far this year, a higher proportion compared to previous years, according to the JLL Senior Housing & CARE Investor Survey and Trends outlook published this spring.

Data gathered from the National Investment Center for Seniors Housing & Care (NIC) reflected this statistic, with nearly $1 billion spent so far on SNF transactions overwhelmingly tied to private buyers.

“Towards the fourth quarter of 2020, we started seeing many of these large SNF deals being announced — and that private equity has taken them over,” noted Wong-Hammond. “[For] many of these announcements … per unit prices, or cap rates, weren’t detailed, but we know from credible sources that many of these were at all-time highs for its geography. These portfolios traded in the Southeast and in the Mid-Atlantic at prices that were … higher than pre-pandemic levels.”

Some of the larger private transactions that took place at the end of 2020 and into 2021 include the private REIT Eagle Arc Partners in November acquiring 20 SNFs for more than $320 million; TL Management purchasing a $507 million Florida SNF portfolio in December; and Peace Capital and Aurora Health Network, through a joint venture, acquiring 35 Genesis SNFs from Welltower for $500 million, with Welltower retaining a preferred equity position.

JLL said the total price per bed for skilled nursing facilities increased year-over-year by 22% in the first quarter of 2021 — and that’s a first for this sector, the report said. From 2016 to 2020, SNF bed prices declined.

Shareholders, pandemic uncertainty

Public owners of SNF assets are, in some cases, seeing a 20% drop in share prices,Wong-Hammond said, as a result of pandemic losses and public perception.

She calls it “headline risk,” referring to the negative press SNFs received when COVID-19 outbreaks started last March.

Many have adopted a wait-and-see approach to investment opportunities and relied on a diverse portfolio across the care continuum, with multiple types of senior housing.

“During the COVID year, those public health care REITs just sat on the sidelines,” added Wong-Hammond. “In a typical year, the [public] health care REITs were the ones making these larger transactions, buying billion dollar portfolios from each other.”

Public REITs have been taking the time to clean house instead of looking to other ventures, but if a decent opportunity presents itself, a public investor may bite.

“When you have dislocated markets, and you have challenges in the industry, it presents an opportunity for private buyers, whether it’s private equity, or even operators,” Scott White, chief executive of public real estate investment trust Invesque. “That doesn’t mean all [public businesses] aren’t interested in owning skilled nursing assets. There’s still some public companies that own skilled nursing assets — that’s core to who they are and what they’re about.”

The Carmel, Ind.-based public REIT announced during a May earnings call the divestiture in part of its Symphony Care Network to the private REIT and management company Cascade Capital Group via operating lease, along with sales back to Symphony.

During the same earnings call this year, Invesque execs said the team completed expansion projects in Virginia and refinancing transactions.

Long term, White said Invesque will shed 50% of its underperforming Symphony portfolio, while at the same time strengthening its relationship with privately-held Cascade.

Future transaction trends

Industry leaders believe more transactions will take place once stimulus money to nursing homes dries up, but the sector overall will survive.

Wong-Hammond considers the federal government’s expected weaning of funds as a positive indication that the industry will bounce back.

“I think there are going to be some players that will end up closing shop because this money has stopped. … Their operations were propped up mainly because of this revenue line from the stimulus checks,” said Wong-Hammond. “The other shoe feels like it’s gonna drop, and it will be impactful, but I think overall it’s a good sign.”

Chandler echoed those sentiments, especially considering the number of mom-and-pop operators across the continuum. Standalone operators will sell, expended from the pandemic.

“COVID has really stretched them to the limit and I think you’ll start seeing a little bit more of that in the next year,” he said. “A regional larger operator [or] national operator could come in on some of these.”

Companies featured in this article:

Cascade Capital Group, Invesque, JLL, LTC Properties, Lument, NIC, Omega Healthcare Investors, Symphony Care Network, Welltower