Even as the nationwide vaccine rollout eases the clinical crisis in U.S. nursing homes, operators across the senior living spectrum are reporting the highest levels of agency staffing use and overtime pay since the pandemic began — indicating that the longstanding workforce crunch in the sector only has only continued to worsen.

That’s according to the National Investment Center for Seniors Housing & Care’s (NIC) most recent survey of skilled nursing and senior living executives, now in its 25th iteration since the COVID-19 pandemic began.

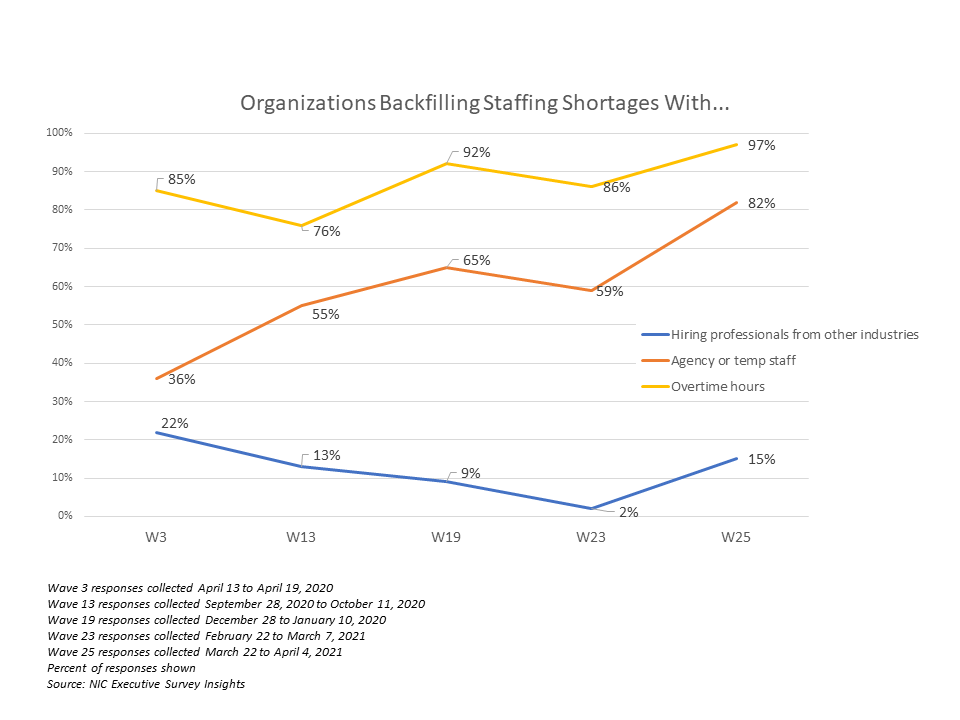

“Currently, two-thirds of organizations report staffing shortages within their portfolio of properties,” NIC senior principal Lana Peck observed. “Adding to the challenge, nearly all respondents to the Wave 25 survey were paying staff overtime hours, and four out of five organizations were tapping agency/temp staff.”

While overtime pay has been a key strategy for operators looking to fill staffing gaps since the very beginning of the pandemic, the use of agency staff has been on a relatively steady increase — with the 82% figure reported during this most recent wave far surpassing the 36% rate seen over the week of April 13, 2020.

The NIC data comes from leaders at 64 skilled nursing and senior living operators across the country, with a collection period of March 22 to April 4.

Insufficient staffing was just one of the long-simmering nursing home issues that the COVID-19 pandemic exposed with deadly force over the past year. Between 2017 and 2018, median turnover at U.S. nursing facilities was 94%, according to a study published last month, with even worse churn at properties with the lowest ratings from the federal government.

Already understaffed prior to the crisis, facilities have struggled to keep shifts fully covered amid positive cases among workers and very real fears among caregivers of contracting the virus. Early research has indicated that better-staffed facilities were more able to contain outbreaks when they did occur as compared to their understaffed peers; workers taking shifts at multiple nursing homes to make ends meet, a common reality for underpaid certified nursing assistants (CNAs), was also identified as an early driver of asymptomatic COVID-19 transmission in nursing homes.

“Recent concerns regarding the spread of COVID-19 in care facilities have heightened awareness of the possible implications of nursing

staff stability for infection control, which may prove a particularly important consideration during the current pandemic and in future

public health emergencies,” the researchers behind the turnover study noted. “Facilities with lower turnover rates may be better positioned to withstand challenges, such as absences because of sickness. Staff members at such facilities may also be more familiar with the infection control protocols of their facility.”

CNAs, advocates, and some operators have increased calls in recent months to boost pay for the role as a way to solve both the struggles faced by frontline caregivers and to improve the overall quality of nursing homes in the wake of COVID-19.

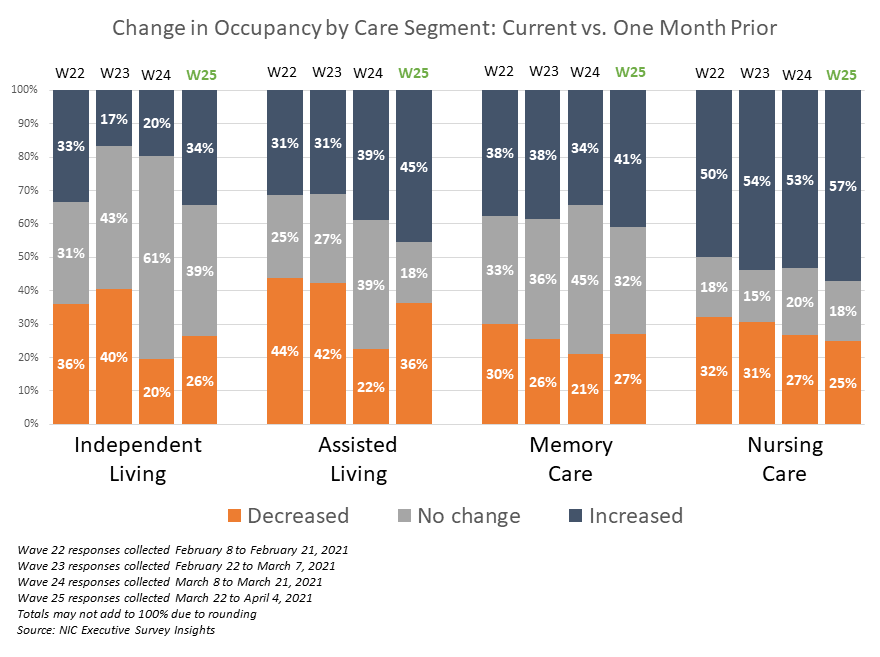

The NIC survey didn’t contain all bad news for the sector. On the inoculation front, 92% of residents across all settings were fully vaccinated as of the first week of April, as compared with 63% of staffers. Occupancy at nursing care facilities has also seen the fastest increase among all care types, with 57% of respondents reporting some month-over-month increase in census — compared to 34% in senior housing and 45% in assisted living.

Those numbers provide some backing to the growing perception that, at least in the near-term, SNFs have a clearer path to recovery than other, lower-acuity senior care settings — particularly due to a combination of federal relief dollars and the non-discretionary nature of nursing home stays.

“My overarching thought on skilled nursing is before the pandemic, people were worried about what they called ‘stroke-of-the-pen risk’ — by that I mean CMS or other payer programs just unilaterally cutting payment terms,” National Health Investors (NYSE: NHI) Eric Mendelsohn said recently. “Now you’ve had the opposite of that. You’ve had a unilateral assistance from the government in a positive way, so the reactions from the market could be skilled nursing becomes more valuable [and] cap rates go down because it is less of a perceived risk.”