More than any other issue, liability shields for nursing home operators have consistently generated headlines and public outrage as lawmakers and regulators look to sort out the top areas of reform in the wake of the COVID-19 pandemic.

States across the country have come under fire for including nursing homes in legislation that provides blanket lawsuit protections for health care providers.

Given the once-in-a-lifetime nature of the coronavirus pandemic and a variety of factors outside of their control — including supply chain disruptions and lack of access to testing in the crucial early days of the crisis — hospitals and nursing homes have asserted that they shouldn’t face a wave of civil suits over the coming years, arguing that it would force many players out of business and further curb access to care.

Advocates, families, and personal-injury attorneys have countered that long-standing problems in the nursing home sector, such as low staffing and lackluster infection-control compliance, exacerbated the impact of COVID-19 on residents and workers — and that the liability shields would spare operators from being held accountable for abuse and neglect unrelated to the pandemic.

The fight over civil suits is unlikely to abate as the pandemic drags on and a new Democratic administration looks to play a more hands-on regulatory role than the outgoing Trump regime.

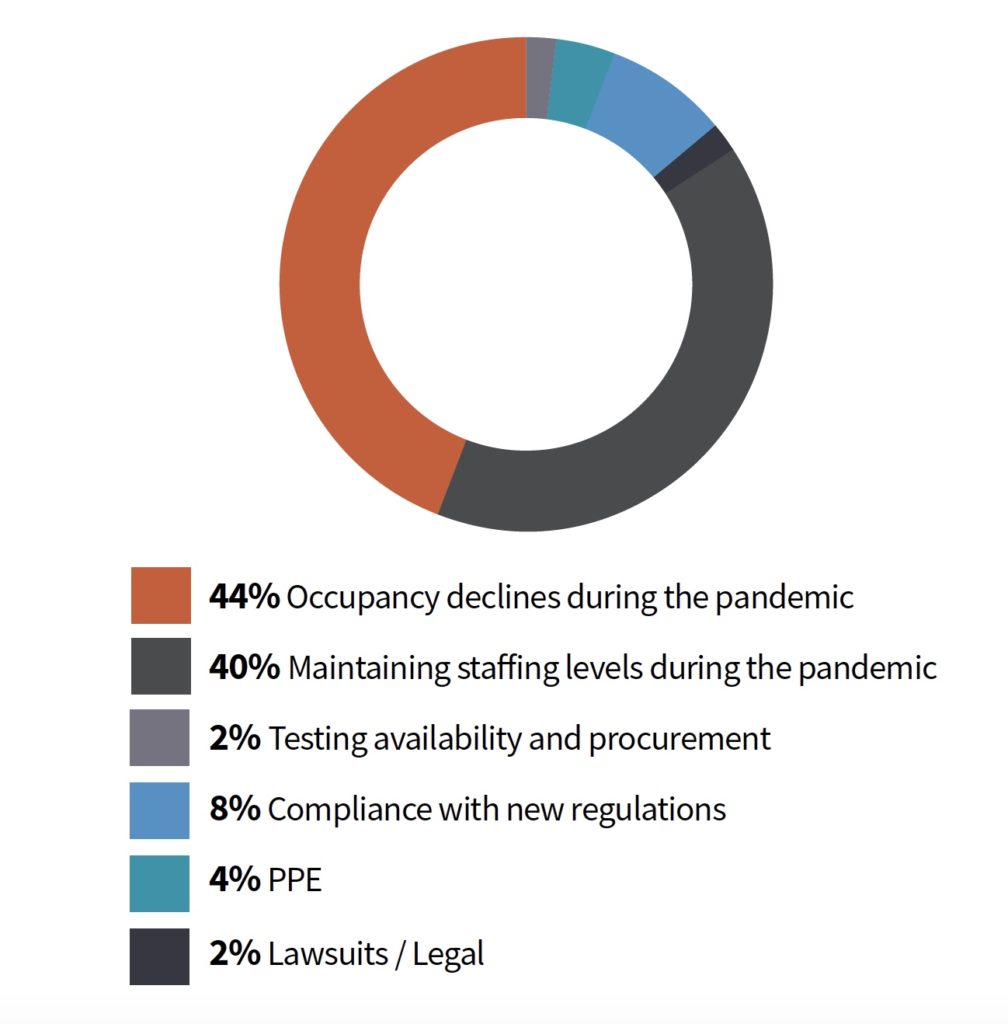

But at least according to the annual Skilled Nursing News outlook survey, fear of lawsuits ranked dead last on a list of potential stressors for nursing home operators in 2021.

Lawsuits/legal issues tied with testing availability, identified by just 2% of the more than 200 SNN readers who responded to our non-scientific online poll. Even the specter of compliance with new regulations, a likely area of reform over the coming months, was the primary concern for 8% of respondents.

Unsurprisingly, occupancy and staffing combined to top 84% of readers’ lists of COVID-19 concerns for the year ahead. Recent census data for nursing homes has shown no signs of recovery as home health agencies continue to siphon away post-acute business, with residents and their families fearful of COVID-19 infections in institutional settings — and also unwilling to accept visitation restrictions that continue to remain in force across the country.

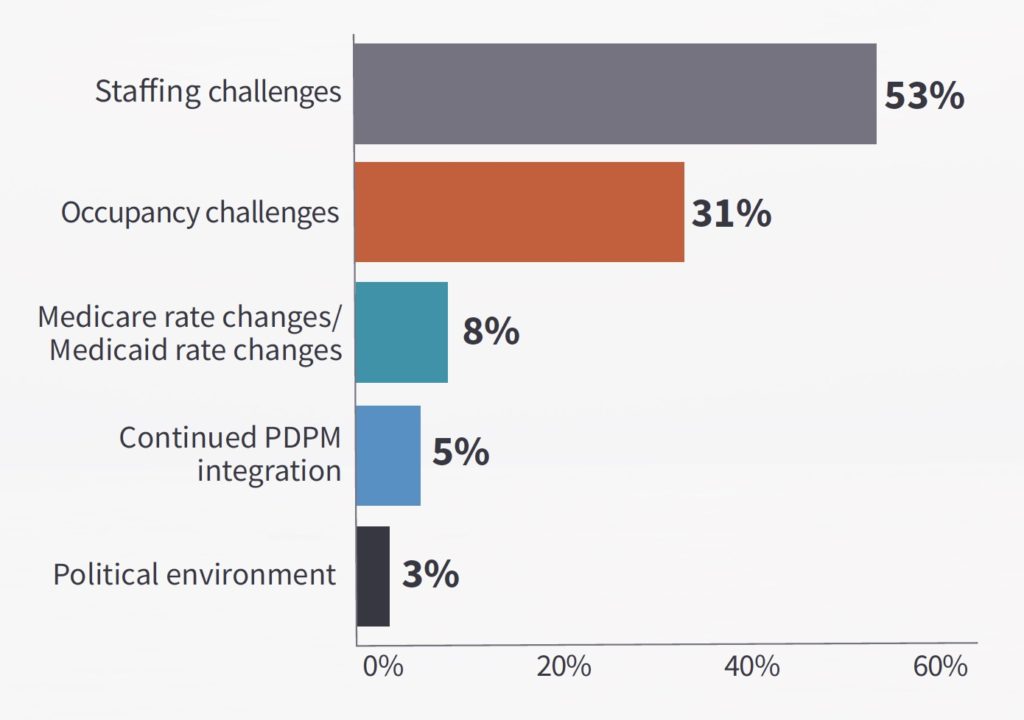

The staffing crunch, already a problem before the pandemic, has only gotten worse since May 2020, with a new analysis finding a greater proportion of facilities reporting shortages at the end of the year than in the spring.

When asked for top challenges outside of COVID-19, the answer was unsurprisingly the same: Staffing and occupancy ruled the list, with issues around Medicare and Medicaid rates falling far below.

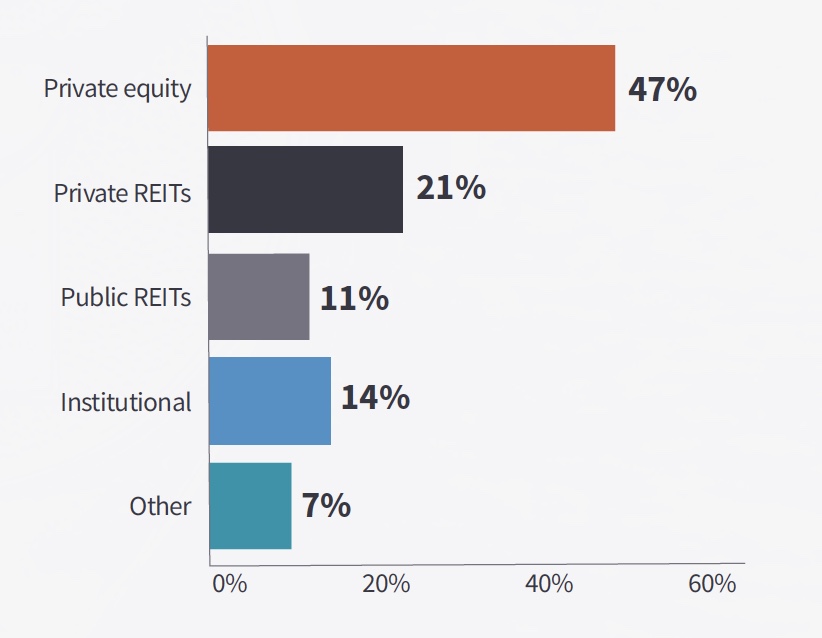

Moving toward the financial side of the equation, our readers predicted continued interest from private equity firms in long-term and post-acute assets — this despite a year that saw intense scrutiny on PE investment in the space, and research indicating that PE-backed facilities may have had worse COVID outcomes than other nursing homes.

Even still, a near-majority of SNN readers thought PE will be the most voracious buyer of nursing homes in 2021, followed by private and public real estate investment trusts (REITs) and institutional investors.

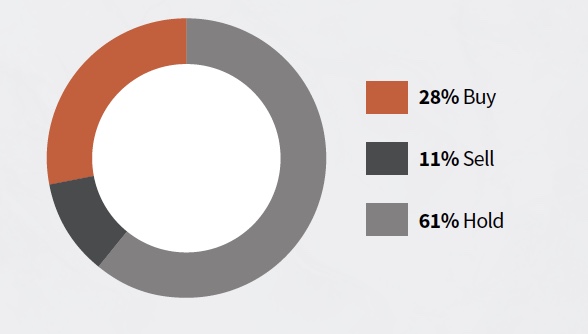

Of course, those potential buyers need available assets, and our readers didn’t predict that there would be too many on the market for sale: Just 11% of respondents said their organization was likely to offload properties in 2021, with less than 30% indicating a desire to buy — potentially portending a year of status quo in the M&A marketplace.

For the complete set of results on the outlook for 2021, including top new strategies for success and ongoing sentiment on the Patient-Driven Payment Model (PDPM) for Medicare reimbursement, download the full free report.