The Patient-Driven Payment Model (PDPM), the overhaul to Medicare reimbursement for skilled nursing facilities that took effect in October of 2019, has proven its worth as a mechanism for paying for nursing care during a global pandemic.

It has, however, been “anything but revenue-neutral,” at least in terms of how much money the government is spending on Medicare-covered stays in SNFs, Joel Wright, the vice president of operations at Therapy Management Corporation (TMC), said during an October 20 webinar.

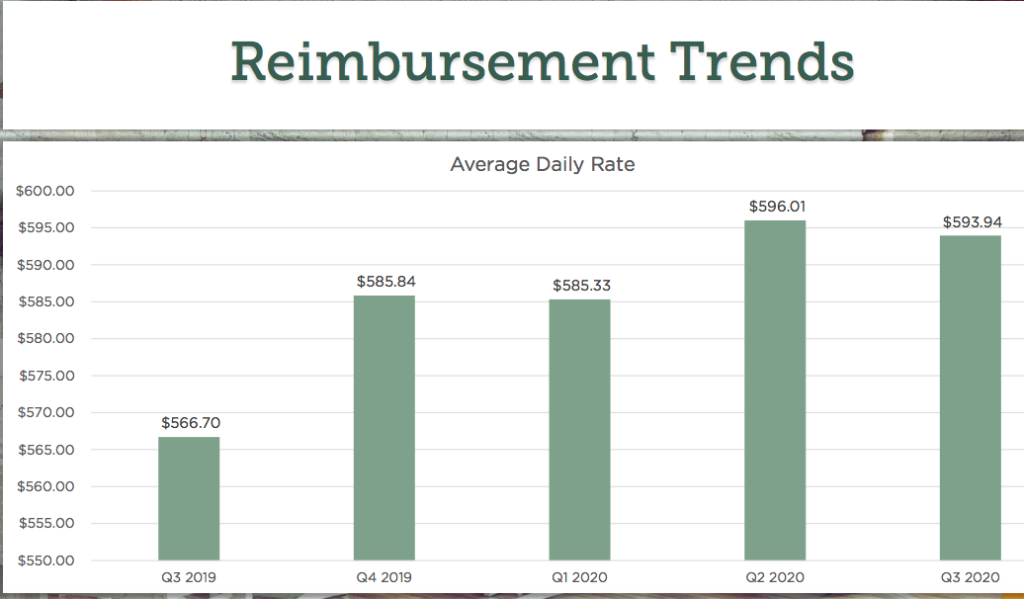

This is striking given that the new system was designed to have government spending stay the same as it had been under the old Medicare reimbursement model, the Resource Utilization Group (RUG) system. But the average daily rate generally rose from the third quarter of 2019 until now, as TMC highlighted in its presentation.

The reason for that lies in the Minimum Data Set (MDS) — specifically how providers became more adept in capturing information for it, he explained.

“Across the country, we saw daily rates increase under PDPM,” Wright said. “The reason it was not revenue-neutral was because CMS had planned for MDS coding to remain the same. So they set the case mixes at exactly the right amount, so that total rates would not change. They never counted on people changing the way that they coded post-PDPM.”

Under PDPM, providers are reimbursed based on the levels of care a patient needs, drawing upon five key areas: physical therapy (PT), occupational therapy (OT), speech therapy (ST), nursing care, and non-therapy ancillary services.

And it was in some of those case-mix areas where the Centers for Medicare & Medicaid Services’ projections appear to have been off the mark, Wright explained on the webinar.

“It didn’t matter before, if things were missed on the MDS, it was unlikely to be noticed and so education and correction was unlikely to happen,” he said. “Under PDPM, though, we’re all very aware of what goes on to the MDS, and so we find that less gets missed.”

Specifically, CMS had expected that the coding for nursing and speech would stay the same; they actually increased, Wright said. On the other hand, CMS appears to have overshot on its projections for NTA reimbursement rates; these were not as high as the agency had predicted they would be.

In terms of conditions that affect payment, depression remains a critical one; before PDPM, less than 1% of residents were positive for this condition, but now it’s about 8%, Wright said.

“Now if you look at what it takes to qualify for depression, you’d argue that far more than 8% of residents should be qualifying … the threshold for depression is not that high a mark for somebody who’s just going into a nursing home,” he noted.

Another is whether or not a patient qualifies as “special care high,” which has an impact of roughly $45 a day in the nursing payment area and like depression, has seen a significant increase. The two main drivers for the boost are intravenous fluids in the hospital and chronic obstructive pulmonary disease (COPD) with shortness of breath while lying flat, according to Wright.

For IVs, the change is less because of providers making coding corrections and more due to a change in assessment reference date, he said.

“It used to be that an average assessment reference date happened on day 7.2 under RUG-IV,” he said. “And now it’s not uncommon to see a falling between Day 1 and Day 3. The reason is because under RUG-IV, hours and minutes of therapy counted, so pushing it back meant that you captured more of the minutes that happened. On Day 1 through 3, it allows you to look back at seven days, which includes parts of the hospital day. And it is so common when you’re in the hospital to be receiving IV fluids.”

That is likely the top reason for the increase in special care high, which rose from around 9% of patient days to about 33% of patient days.

Another driver in the increase is isolation, which is primarily the driver of rate changes post-COVID, Wright said. Even though this only applies to a small number of patients, the rate change is so significant, at approximately $140, that it makes a difference.

In terms of speech therapy, swallowing issues are being captured at higher rates, as are dietary modifications: Swallowing issues rose from about 20% of residents to 30% of residents, while dietary modifications rose from about 5% of residents to about 20%. Either of those could add about $18 per day to rates, Wright noted.

‘No evidence’ of therapy focus from CMS

Before the COVID-19 pandemic, the sheer number of so-called “winners,” or operators doing better under the new system than they had under the old, had raised concerns about the sustainability of the new system. There were also worries about how the government might respond to any changes in behavior by providers; CMS had said in the early days of PDPM that it would be closely watching therapy minutes to see if there was a drastic change.

Wright said he was predicting Part A denials based only on the need for skilled therapy, but this was not borne out in the months after PDPM was implemented.

“Part A is quiet from from an ADR [additional documentation request] standpoint — virtually nothing happening,” he said. “CMS said pre-PDPM they would be looking at therapy minutes. We have no indication that that happened. It might be that our minutes didn’t drop that much, and that’s why we don’t have evidence of it. But I haven’t heard of any evidence of it.”

The COVID-19 pandemic also makes it very unlikely that the agency will do a comparison of minutes before and after PDPM, given the uncertainty around how widespread COVID is in a given building and the need to limit the spread if an outbreak is occurring, he argued. Therapy is quite likely to decrease in such a situation.

Managed care companies are another story entirely.

“We continue to see ADRs from the managed care companies,” Wright said. “If I tell you which one is most common, you won’t be surprised … I would say we get more reviews from Humana Inc. (NYSE: HUM) than all the rest combined. UnitedHealthcare (NYSE: UNH) is probably a distant second.”

That said, most of these do not go past the ADR stage, Wright observed, with the vast majority paid at the initial stage before ever reaching denial.

The companies have primarily focused on poor coding of Section GG, which focuses on the patient’s functional capabilities and deficits in the first three days of a stay and affects reimbursement for occupational and physical therapy, Wright said. That’s the top reason for them to deny a claim; the second-most common reason is “what they feel is inappropriate coding of diagnoses,” he said.

COVID-19’s impact on therapy and quality measures

The arrival of the pandemic overturned many of the calculations on which providers and other SNF stakeholders had been building their hopes for upside under PDPM, particularly with regard to therapy.

The most significant impacts came after the first quarter, and so any major differences between the first and second quarters of 2020 are likely due to the pandemic, Wright said on the webinar. The speech and nursing components shifted significantly between the quarters, for instance, while the NTA, PT, and OT components saw slight declines.

The slight decrease for PT and OT is not surprising, likely because of an increase of medical management cases under COVID-19, but the NTA dropping slightly could be an indicator of “coding fatigue,” Wright said.

It’s especially concerning because some of the factors that drove increases in the nursing component should have driven rises in the NTA, he explained.

“You’ve got to be very diligent and if you’re missing even one thing, it’s impactful to your case mix,” Wright said. “I would have expected that COVID would have had a positive influence on NTA, and we didn’t see that … we see a lot of signs that we need to refocus in on NTA.”

Section GG gains are down 6% since the start of the pandemic, indicating something of a toll on therapy outcomes, he noted, and though providers are adapting, some of the elements of the pandemic that make it difficult to provide therapy simply aren’t going away any time soon.

Another critical area for operators is that of quality measures — even though this measure won’t make its way to the fore for another few months, given the lag in their appearance on CMS’ Nursing Home Compare tool. The toll COVID-19 has taken on residents and families is still coming into focus, but in examining the Certification and Survey Provider Enhanced Reports (CASPER) for all its sites, TMC was able to quantify some of the damage.

While falls with injury have dropped 17% from the 2019 fourth quarter compared with the three months ending July 31 of this year, several other problems have emerged. Loss of movement is up 55%, loss of activities of daily living is up 15%, and unexplained weight loss is up a troubling 65%, according to TMC.

“There’s no doubt that these impacts are due to isolations and change in the staffing patterns,” Wright said. “I’m telling everybody about these numbers, as soon as I hear it, I’ve talked to some people who aren’t our clients, and they’re seeing exactly the same thing on their end too. So I know it’s a widespread issue.”