The average total margin for freestanding nursing homes dropped to -0.3% in 2018, according to a new report from the Medicare Payment Advisory Commission (MedPAC) — the first time that group found a negative overall margin since 1999.

That said, Medicare revenue remained relatively strong in 2018, the most recent year for which data was available: Standalone skilled nursing facilities logged an average margin of 10.3%, the 19th consecutive year that figure sat above 10%.

But the Medicare margin has been on the decline in recent years, falling from as high as 14.1% back in 2012.

MedPAC serves as a non-partisan agency of the federal legislative branch, providing analyses and advice on Medicare payment policy to Congress.

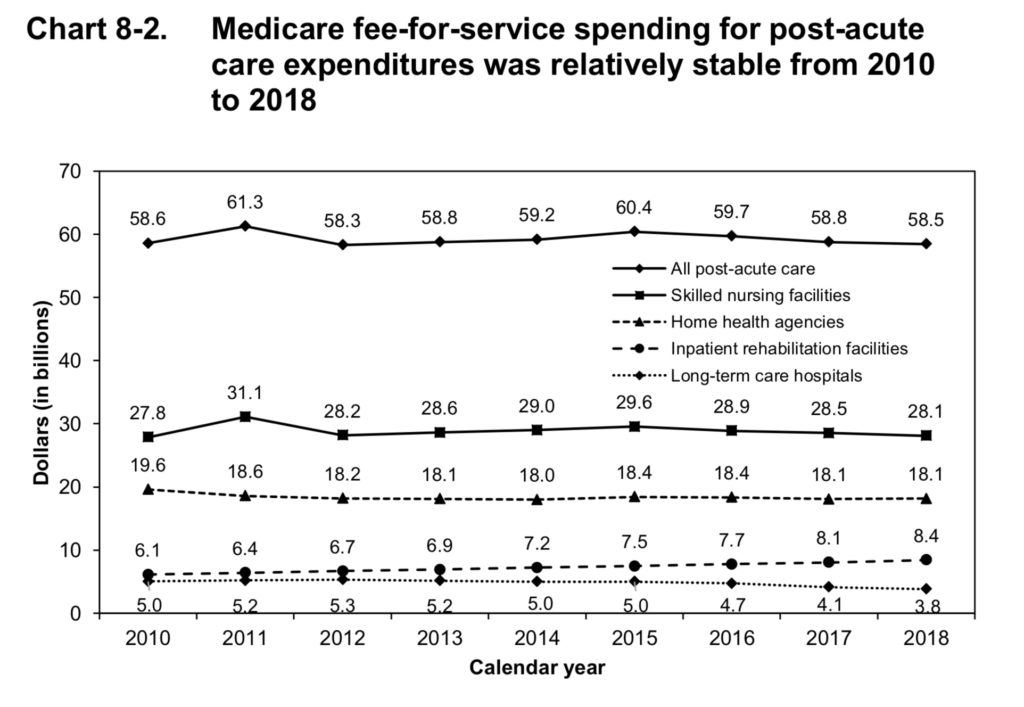

Overall Medicare fee-for-service spending on care at skilled nursing facilities has remained relatively static over the past decade, clocking in at $28.1 billion in 2018, slightly down from $28.5 billion the year before.

The total number of skilled nursing facilities declined by a little under 1% during between 2018 and 2019, falling from 15,230 to 15,114. For comparison, among the post-acute settings MedPAC analyzed, home health agencies experienced the most significant contraction with a reduction of 3.6%.

MedPAC isn’t the only group that has found nursing facilities’ margins hovering at the brink, with consulting firm CLA pegging the number at -0.1% last fall. A subsequent report from Plante Moran, released this past January, estimated the median net margin at 0.21%

Fee-for-service Medicare reimbursements remain the most prized source of revenue for nursing facility operators, as they come in several hundreds of dollars per day higher than rates from Medicare Advantage plans and Medicaid.

But as alternate payment models and managed care insurers eat up an increasing share of a given facility’s payment streams, the strain on the bottom line has increased; in many cases, providers must find just the right balance between Medicare-funded post-acute services and Medicaid-covered long-term care residents to survive.

“There is a clear bifurcation of post-acute and long-term care services within a SNF, and it’s becoming increasingly difficult to achieve financial success in both service lines,” Plante Moran noted in its analysis. “Overall SNF net margins indicate that a majority of facilities are just breaking even financially, suggesting that long-term financial viability is uncertain.”