Conventional wisdom holds that Medicare Advantage saves the government money by bringing a private-sector insurer’s focus on efficiency to the more freewheeling federal Medicare program.

But that progress may have way more to do with the types of people who elect Medicare Advantage coverage — and much less to do with the cost-cutting strategies of insurers, according to a new study from the Kaiser Family Foundation.

“This study suggests that differences in health care use, and spending, are evident before beneficiaries decided to enroll in Medicare Advantage plans or remain in traditional Medicare, raising questions about the extent to which plans are actually lowering spending or managing care,” the authors — Kaiser’s Gretchen Jacobson, Tricia Neuman, and Anthony Damico — wrote in their findings, published Tuesday.

Using 2015 and 2016 Medicare data, the team looked at the differences in spending between traditional Medicare and MA plans across a variety of demographics and conditions. Overall, each person who switched to a managed plan in 2016 had actually cost the government $1,253 less than the average Medicare beneficiary in 2015 — meaning they were already a lower-cost option regardless of their Medicare status. The effect holds for beneficiaries with specific health conditions, including diabetes, asthma, and even breast or prostate cancer, the researchers found.

The observation works in the other direction as well. The Kaiser team took a dive into so-called dual-eligible beneficiaries, or those who qualify for both Medicare and Medicaid. This population represents a costly problem for the government and insurers to solve, as dual-eligibles generally have multiple chronic conditions and more precarious living circumstances.

The highest-cost dual-eligibles were more likely to stay in traditional Medicare between 2015 and 2016, Kaiser found, thus helping to reinforce the selection-bias effect of reduced Medicare Advantage spending; lower-cost partial dual-eligibles were more likely to opt into MA.

“The results suggest that favorable self-selection into Medicare Advantage plans is occurring, even among traditional Medicare beneficiaries with similar health conditions,” the team concluded. “The findings raise questions as to why beneficiaries who are higher utilizers are less likely to go into Medicare Advantage and instead remain in traditional Medicare.”

The answer to that question could have significant ramifications for the government and providers. If Medicare Advantage continues to serve relatively healthier enrollees who cost the government less money than their Medicare counterparts, the team argues, the Centers for Medicare & Medicaid Services (CMS) could be overestimating expected MA costs to the tune of billions.

“To illustrate, if the difference in average Medicare spending ($1,253) applied to just 10% of all Medicare Advantage enrollees in 2016, or 1.8 million enrollees, it would amount to more than $2 billion in excess spending in one year alone,” the group noted.

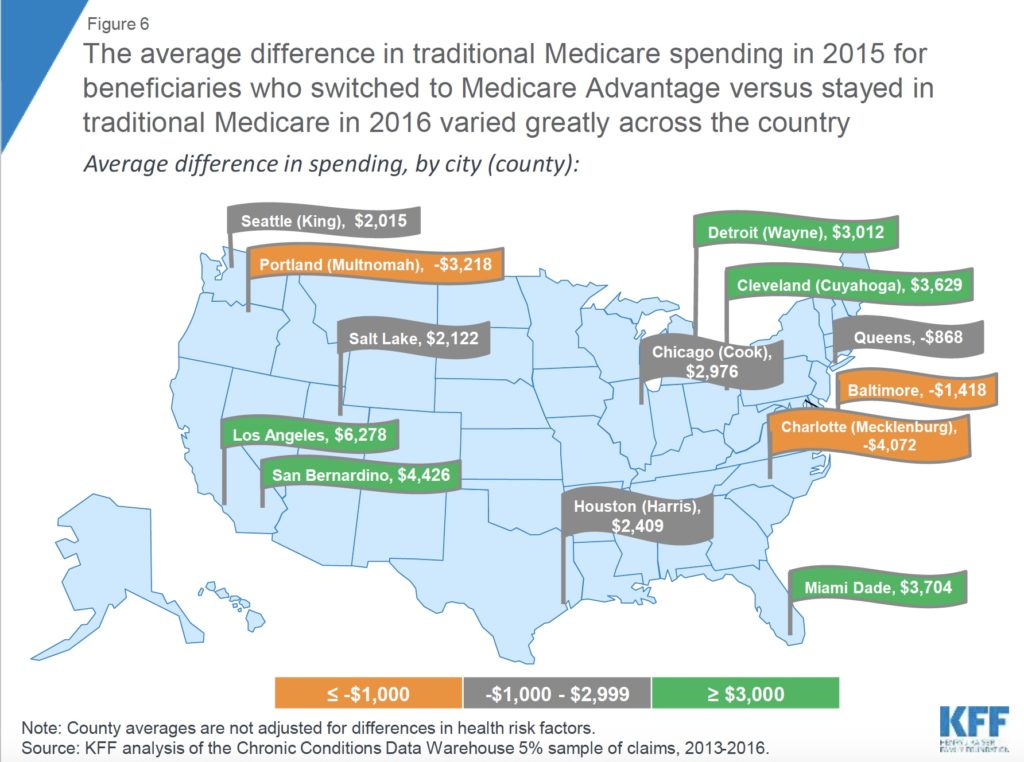

There were some regional wrinkles in the analysis, however. In multiple large markets across the country, higher-cost Medicare beneficiaries were the ones electing to switch to Medicare Advantage — including Pittsburgh, Buffalo, Baltimore, and Charlotte, N.C.

The Kaiser researchers also identified a potential opportunity for Institutional Special Needs Plans (I-SNPs), or special Medicare Advantage plans designed to cover residents in nursing homes and other institutional settings. Nursing facility residents who elected to switch to MA in 2016 actually cost traditional Medicare $1,825 less than average in the previous year, illustrating a potential reason why the plans have risen in popularity in recent years.

“If higher-cost nursing home residents are remaining in traditional Medicare while lower-cost residents are moving to Medicare Advantage plans, it could make it easier for Medicare Advantage plans serving the nursing home population to be profitable,” they wrote.