As a reporter and editor covering the skilled nursing industry, it’s safe to say that I’ve been in the PDPM business for the last year-plus — and business has been very good.

The Patient-Driven Payment Model represents the most sweeping Medicare reimbursement change in more than two decades, and so far has provided industry leaders with almost too many angles to probe. From the increased role of coding to the potential for litigation headaches to the rise of speech therapy, PDPM is poised to radically change the way operators — particularly those that focus on short-term rehab — approach their businesses.

All of this attention is roundly justified. Traditional fee-for-service Medicare represents the sweetest plum for any nursing facility operator, providing the highest daily reimbursement rates while also remaining immune from state-level vagaries and Medicare Advantage headaches. Any leader ignoring PDPM would be doing so at his or her own extreme risk, as it will not only change balance sheets starting October 1, but also mark the latest step in the federal government’s big-picture shift to value-based care.

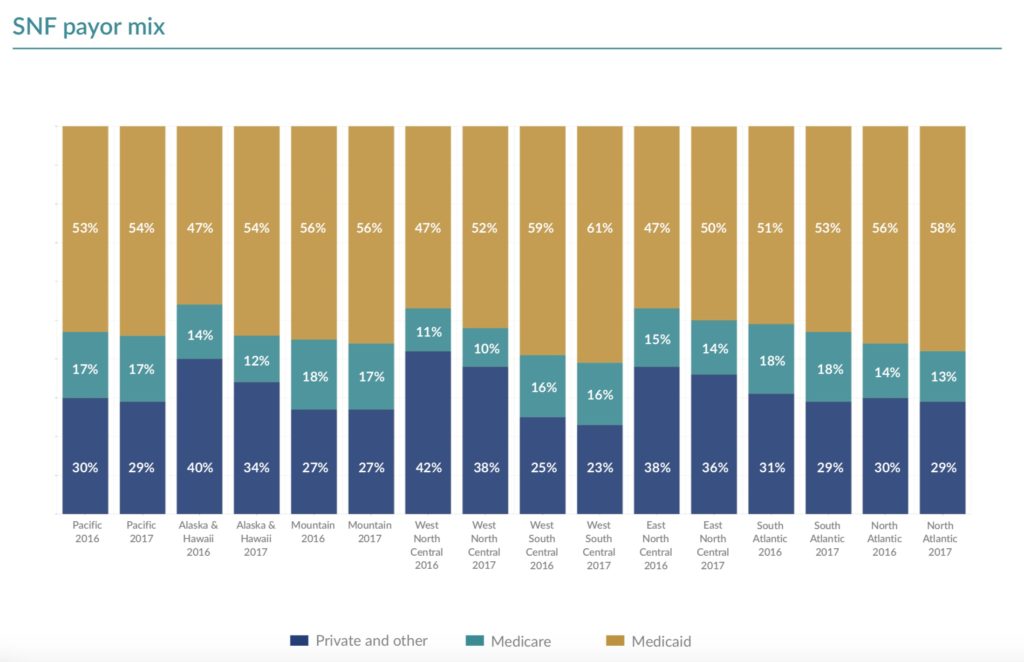

That having been said, there’s one fact that seems to get lost in the PDPM shuffle: For the average skilled nursing facility, Medicare represents the the smallest slice of the reimbursement pie by far, peaking at 18% for operators in certain regions in 2017, according to a recent benchmarking analysis from Plante Moran.

Medicaid, meanwhile, accounts for roughly half of a typical SNF’s income regardless of region, with buildings in certain areas relying on the program for more than 60% of their income.

If I tend to reference this chart in my coverage of Medicare and Medicaid issues frequently, it’s because it represents a gut-check for both myself and, I hope, our readers. It’s easy to get so lost in the novelty and immediacy of PDPM that we forget about the work that still must be done on Medicaid, a vital program that remains all too vulnerable to political whims at both the national and local levels.

PDPM, while a seismic shift in the skilled nursing industry that will continue to affect the course of the space for the next decade, doesn’t solve what Genesis HealthCare (NYSE: GEN) CEO George Hager has called simply “the Medicaid problem.”

Since he used that phrase in an interview last fall, the problem has only metastasized further. Provider groups across the country have sounded the alarm as long-neglected Medicaid rates continue to lag behind the cost of providing services to the citizens who rely on them.

In Massachusetts, for example, leaders have blamed insufficient Medicaid payments for the closure of 20 SNFs over the last year, with 35 more in grave danger of shuttering if lawmakers don’t make their first rate updates for nursing homes since 2007. In Pennsylvania, the average building loses about $48 per patient day on Medicaid residents, causing the leader of that state’s LeadingAge affiliate to declare a “crisis.”

The list goes on: Wisconsin SNFs lose more than $70 per Medicare patient every day, contributing to a wave of closures and receiverships in the Badger State. Operators in South Dakota — which has the dubious distinction of having the lowest daily Medicaid reimbursement payments in the country at $146 — lose $42 million annually caring for Medicaid residents, who represent 55% of the typical South Dakota SNF’s census.

Industry leaders across the country are correct in deeming this a crisis, not just for operators who struggle to fulfill their missions amid ever-tightening budgets, but also for the elderly Americans for whom Medicaid represents their only lifeline. Without fully funded Medicaid benefits for long-term care, untold numbers of our friends, relatives, and neighbors — people who spent their whole lives paying into the state-level Medicaid systems through taxes — could find themselves with no viable care options.

Private-pay seniors housing, while filling an important need for millions, remains out of reach for too many Americans. More than half of middle-income seniors will find themselves priced out of senior living options by 2029, a recent study found, and even if they can afford assisted or independent living, they could eventually require round-the-clock medical care that only a SNF can provide.

And despite increasing knowledge of the aging demographic wave about to crash on the United States, Medicaid remains susceptible to budget cuts at both the state and federal levels. Most recently, industry advocates rallied to prevent draconian cuts to the program during the 2017 battle over repealing the Affordable Care Act, successfully raising awareness that Medicaid forms the backbone of long-term senior care in this country.

But even as officials continue to float either outright cuts or strategic changes to the way Medicaid receives funding, the danger doesn’t always take the form of the axe; instead, as in Massachusetts and other states where rates haven’t been updated in more than a decade, simple neglect can be just as deadly as a slash.

That’s why it’s incumbent upon every provider, investor, and vendor to show state-level lawmakers just how important Medicaid is to their survival — and the survival of the elderly Americans that we have a responsibility to protect. Call your state representative or senator, and invite him or her to tour one of your facilities. Tell your contacts in the state government about the pressures you face, and the victories that you’ve still achieved even in the face of trouble. Keep close tabs on your state’s legislative schedules, and send one of your leaders to testify at hearings that cover Medicaid reimbursements.

It certainly sounds like a tall order, considering the attention operators still must pay to PDPM, a shifting star-rating system, and other issues that cause problems on a daily basis. But taking a back seat in the state-level Medicaid battles that have swept the landscape in recent years could result in disaster — and render any attention paid to the new Medicare payment model meaningless in the long run.