The recent bullish performance of publicly traded real estate investment trusts (REITs) could have a virtuous cycle effect in the space, potentially boosting mergers-and-acquisitions activity in the skilled nursing and broader health care industries.

That’s the thesis of Alex Pettee and Hoya Capital Real Estate, a Connecticut-based investment advisory firm that on Monday published a lengthy breakdown of health care REIT space for Seeking Alpha.

“We continue to see a challenging environment for senior housing and public-pay health care REITs in 2019, but believe that the renewed cost of capital advantage over the private markets should grease the wheels for strategic M&A activity, the true competitive advantage that has powered health care REIT outperformance over the past three decades,” Hoya Capital observed in its analysis.

Of particular note for investors has been an overall boost in REIT stock prices since last fall, Pettee told SNN: Stocks across all real estate sectors have risen by 10% to 25% since November amid broadly positive high-level trends for publicly traded REITs.

Over the last three or four years, according to Pettee, market conditions including rising interest rates helped to dampen the main attraction that REITs provide to investors: a lower overall cost of capital than their private-market counterparts. But with the Federal Reserve cutting its projected rate hikes for 2020 and analysts developing a more modest outlook for global economic growth, conditions are returning to REITs’ favor. And as REIT stock prices rise, he said, their ability to raise capital will increase in lockstep, bringing a compounding benefit.

“You’re back in those ‘goldilocks’ economic conditions, which are the perfect conditions for REIT outperformance — and especially REITs that are externally growth-focused, including health care, the more yield-sensitive REITs,” Pettee told SNN.

That doesn’t mean that good times will automatically extend to the skilled nursing mergers-and-acquisitions marketplace, which has seen its fair share of distress between operators and their REIT landlords. Senior Care Centers, for instance, explicitly blamed lease structures for its financial distress when filing for Chapter 11 bankruptcy last December.

“As the entire industry has seen, the leases associated with the communities have become cost-prohibitive,” chief operating officer Michael Beal said in a statement announcing the Dallas-based SCC’s bankruptcy. “This kind of action is absolutely necessary to address those costly leases while continuing to care for our patients and residents.”

In turn, SCC’s REIT landlords have swiftly moved to distance themselves from the operator, with Sabra Health Care REIT (Nasdaq: SBRA) selling off most of its SCC-operated facilities and LTC Properties, Inc. (NYSE: LTC) actively transferring the operations at its SCC buildings to new owners.

But SCC was far from the only company to run into trouble with REITs: Genesis Healthcare (NYSE: GEN), Signature HealthCARE, and Orianna Health Systems have all seen lease restructuring efforts over the last handful of years, as reimbursement stresses and rising wages have made some long-term lease agreements more difficult to handle over time. Genesis CEO George Hager went so far as to write off the entire current state of REIT-SNF leases in comments at a recent industry conference.

“I would argue that the traditional REIT structure in skilled nursing has been proven to be a failure,” Hager said earlier this year, explicitly pointing to annual lease escalators and thin rent coverages that could put pressure on even the most financially stable operators.

Hager’s words didn’t pass without a rebuttal from Sabra CEO Rick Matros.

“It was really disappointing to hear that, given how much the REITs have helped them,” Matros said on his company’s most recent earnings call in February. “If not for the REITs, the company would be bankrupt.”

Perspectives on individual cases and leases aside, the skilled nursing industry can still seem like a risky bet for investors who may not follow the space closely. With a new Medicare reimbursement system set to reshape the skilled nursing world in the fall, national headlines on Medicaid funding crises in states from coast to coast, and continued wage pressure, SNFs might not be the first place people may want to park their capital.

“Operator struggles and policy uncertainty continues to trouble skilled nursing and hospital REITs,” Hoya Capital observed in its analysis. “Don’t expect the political rhetoric or uncertainty to moderate heading into the 2020 presidential election cycle.”

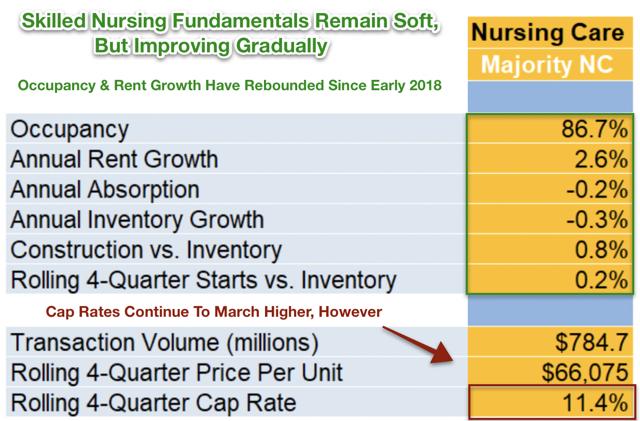

That said, both Hoya Capital and other observers have still found upsides in skilled nursing. Pettee’s analysis pointed to slowly recovering occupancy numbers, as well as a key factor that can make SNFs more appealing to investors: an overall avoidance of the overbuilding boom that has troubled senior housing. If anything, the number of skilled beds in the country is shrinking, and with long-term demographic trends working in the industry’s favor, the United States could soon be facing bed shortages in certain markets.

While acknowledging the ongoing headwinds for skilled nursing providers, Hoya Capital identified REITs as the best option for operators to work through their troubles.

“We continue to believe that these REITs are better positioned than smaller SNF owners to work out favorable deals with operators that may result in short-term pain but longer-term gain,” the firm noted.

In addition, Pettee observed that SNFs still have appeal among investors that have more sensitivity to risk.

“It’s still seen as a troubled sector from the REIT perspective, but it is popular with yield-oriented investors that are willing to assume that extra policy risk,” Pettee said.

Companies featured in this article:

Genesis HealthCare, Hoya Capital Real Estate, LTC Properties, Orianna Health Systems, Senior Care Centers, Signature HealthCARE