Industry leaders had reason to cheer the federal government’s decision to boost Medicare rates for skilled nursing facilities, but the gain could end up only papering over the persistent reimbursement problems in the space.

The Centers for Medicare & Medicaid Services (CMS) last week proposed a 2.5% increase to the Medicare market basket rate, a move that would send an additional $887 million flowing into SNFs’ coffers in fiscal 2020.

The immediate reaction from the industry was positive, with American Health Care Association president and CEO Mark Parkinson thanking CMS and its leader, administrator Seema Verma, for the pay bump. But his commentary also alluded to continued pressures for nursing home operators nationwide, citing a recent analysis from the Medicare Payment Advisory Commission (MedPAC) that pegged average margins for SNFs at 0.5% — even as it called on Congress to forgo the market basket increase given generally higher margins on Medicare residents.

“This increase doesn’t solve these problems, but it gets us headed in the right direction,” Parkinson said in his prepared statement.

SNN set out to ask a variety of sources what a perfect-world pay increase would look like from the federal government, and the answers all returned to the elephant in the room for most operators: Medicaid.

“Any long-term solution to our funding problem must focus on Medicaid,” Parkinson said in a follow-up comment provided to SNN. “That is where our dramatic underfunding occurs, and it’s time for states to step up and take care of the elderly.”

Parkinson’s comment hints at the broader underlying issue with nursing home funding in the United States today. While operators generally covet Medicare residents, who come with significantly higher per-day reimbursements than those covered under Medicaid and managed-care plans, these patients only represent a small slice of any given building’s overall revenue.

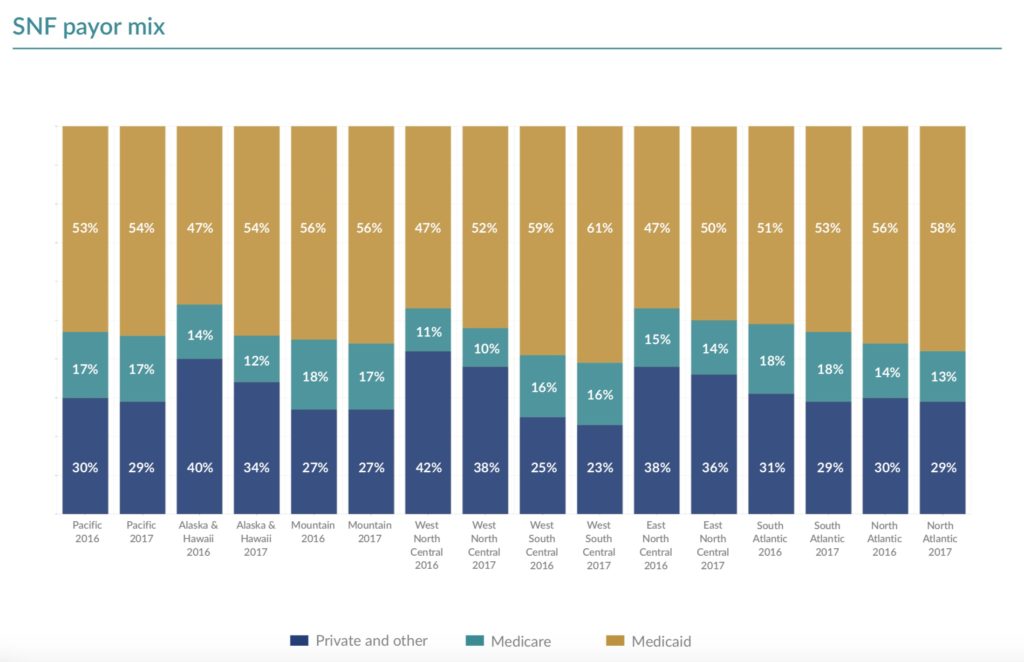

In 2016 and 2017, Medicare accounted for at most 18% of skilled nursing reimbursements, according to a recent benchmarking analysis from the accounting and advisory firm Plante Moran, with the highest penetration in the South Atlantic and Mountain regions. But even for the Medicare winners, Medicaid reimbursements account for nearly half of all nursing home income, with properties in the West South Central region deriving more than 60% of their funding from the program in 2017.

“Regardless of the number associated with the payment update, it paints only a partial picture of the financial picture of nursing homes,” Aaron Tripp, vice president of reimbursement and financing policy at industry association LeadingAge, told SNN. “The trend over the last several years is a decline in Medicare fee-for-service residents in most facilities’ daily payer mix. On average, less than 15% of patient days are directly attributed to the payment rates connected with the annual Medicare payment update.”

Here lies the heart of the math problem for many nursing homes across the country, where state-level reimbursement rates frequently fall well below the cost of caring for Medicaid patients. In Pennsylvania, for instance, nursing facilities lose an estimated $631 million every year on Medicaid residents, as the average facility spends $47.85 more per patient day than they receive from the state. In Massachusetts, a Medicaid rate that hasn’t been updated since 2007 has been blamed for a wave of 20 SNF closures that could end up claiming 35 more buildings without immediate intervention, and multiple other states have turned to novel funding mechanisms to squeeze out extra dollars just to survive.

And with CMS unable to directly boost Medicaid payments to SNFs — and the current administration looking to slash overall federal funding for the program — the recent Medicare hike could come as cold comfort for operators.

“Since overall Medicare volume is significantly less than Medicaid volume, and the Medicaid rate shortfall per patient day is significantly greater, the 2.5% Medicare increase still only is representative of a Band-Aid,” Matthew Bavolack, health care services leader at professional services and advisory firm Marcum LLP, told SNN.

Earlier this year, Marcum released a report finding that the average SNF loses money on each resident to the tune of seven cents per patient day. Though there were certain pockets of profit, the nationwide numbers reinforced the bleak picture for many operators in the space — along with other data from Marcum showing revenue declines, expense increases, and rising debt-to-equity ratios.

Despite the gaps in funding, providers must offer the same quality of care to Medicare and Medicaid recipients, Tripp noted, directly leading to the financial headaches as providers scramble to figure out how to offer one standard of care with multiple standards of payment.

“Greater alignment between the costs and reimbursement to provide high quality care to all nursing home residents across payers — alongside reasonable regulations that support quality outcomes — is what LeadingAge recommends,” Tripp said.

State-level Medicaid issues aren’t the only potential curveballs that could wipe out any gains from the Medicare market basket increase. Bavolack in particular pointed to the October 1 implementation of the Patient-Driven Payment Model (PDPM), an entirely new way of calculating Medicare reimbursements for SNFs that could potentially increase or decrease a given building’s overall income based on a variety of factors. Individual markets’ specific payer mixes can also play a role, he noted, as penetration of Medicare Advantage plans depends largely on geography.

“There are numerous other factors which come into play in terms of identifying what ‘enough’ is,” Bavolack said.

Betsy Rust, the Plante Moran partner who co-authored the benchmarking report, called out the continuing effects of an across-the-board 2% sequestration cut to Medicare funding, as well as PDPM uncertainty and the SNF Value-Based Purchasing (VBP) program — which automatically docks providers an additional 2%, though they can then earn those dollars back by meeting certain hospital readmission benchmarks.

“The market basket increase is good — better than the SNF industry has seen in recent years — but still not adequate” in light of those factors, she said.

Rust also noted the compounding effects of shortening lengths of stay: As Medicare Advantage plans, accountable care organizations, and other new payment models demand residents spend as little time in the SNF as possible, per-day rates aren’t keeping up. Because each resident has certain fixed expenses that don’t change based on the final length of stay — such as intake and discharge costs — shorter stints with similar per-diem payments mean a gradual erosion in net income.

“I wouldn’t feel comfortable citing a [raise] number that would make sense, but we are still losing ground,” Rust said.

Companies featured in this article:

American Health Care Association, Centers for Medicare & Medicaid Services, Marcum LLP, Plante Moran