The blockbuster deal by Welltower Inc. (NYSE: WELL) to acquire skilled nursing provider HCR ManorCare with hospital non-profit ProMedica helped drive a record year for health care mergers and acquisitions, according to a new report from auditing and accounting firm PwC.

The Toledo, Ohio-based real estate investment trust (REIT) closed on the acquisition in July for a total value of $4.4 billion; the deal was announced in April after months of troubles between ManorCare and its former landlord, Quality Care Properties.

The deal — under which Welltower acquired QCP and owns ManorCare’s real estate in the joint venture with ProMedica, while ProMedica acquired the operations — was the fourth-largest health care deal by value in 2018, a year that broke records for deal volume.

“Although deal value declined, the total was still higher than 2015-2016, while megadeal values remain elevated,” PwC noted in its report. “Deal activity is likely to continue given capital availability, potential for disruption from cross-industry alliances, and continuing long-term trends such as regulatory uncertainty, reimbursement pressure, and increased focus on the consumer.”

A total of 1,182 deals closed in 2018, an increase of 14.4% from 2017. Long-term care played a key part in this increase, leading all other sectors with 412 deals for a total value of $12.25 billion in the year. The asset class accounted for 35% of total health care deal volume and 10% of deal value.

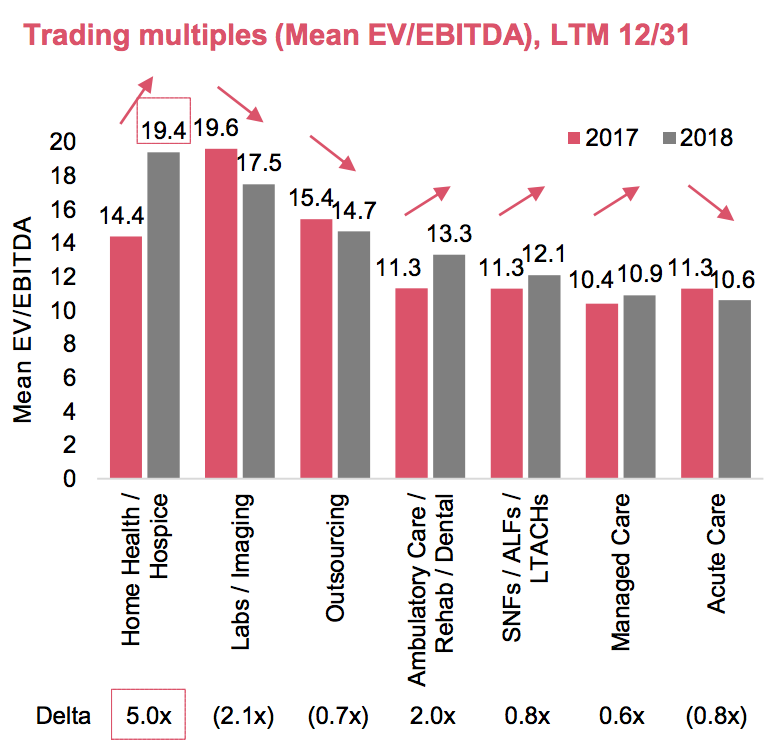

When it comes to valuations, long-term care properties ranked lower, with SNFs, assisted living facilities, and long-term acute care hospitals among the sub-sectors with the lowest multiples.

PwC US Health Services Deals Insights Year-End 2018

PwC US Health Services Deals Insights Year-End 2018The interest in dealmaking is likely to continue this year, PwC U.S. Health Services deals leader Thad Kresho indicated.

“Corporate and private-equity buyers both have access to significant levels of capital, and with double-digit volume growth in some sub-sectors, it’s clear that deals are seen as an important strategy in an increasingly cost- and consumer-conscious ecosystem,” he said in the report.

Capital availability is likely to drive high interest from private equity in the health care sector, while there will be continued interest in cross-industry deals and transactions focused on vertical integration, PwC predicted.