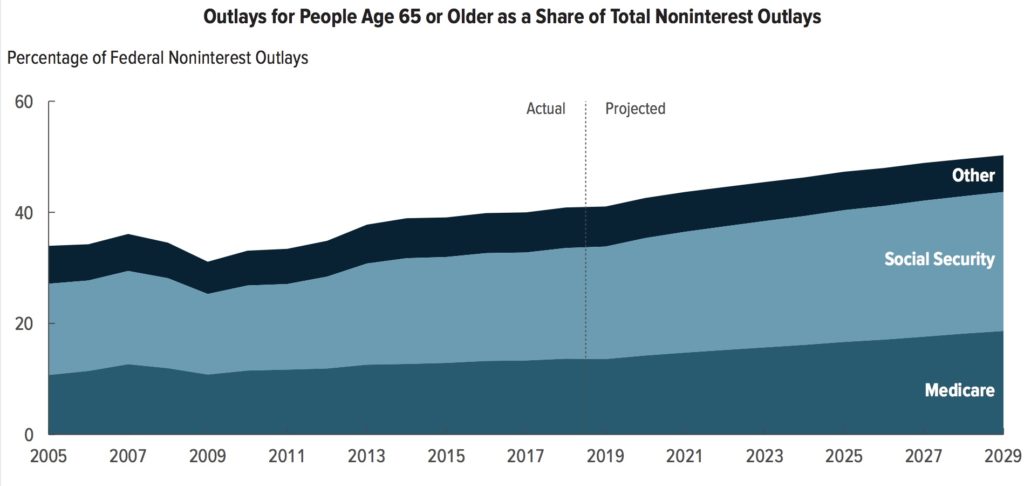

Programs for Americans aged 65 and older will account for nearly half of all the federal government’s non-interest spending in the next decade, a new report from the Congressional Budget Office found, as the baby boom population continues to age into both Medicare and certain Medicaid benefits.

Medicare, Medicaid, and Social Security spending will balloon to 9.8% of total gross domestic product (GDP) by 2029, the CBO determined — compared to around 7.5% last year.

“Over the next decade, as members of the baby-boom generation age and as life expectancy increases, the number of people age 65 or older is expected to continue to rise — by about one-third, from 16% of the population in 2018 to 20% in 2029,” the non-partisan CBO wrote in its general spending outlook for the coming decade, released this week. “As a result, federal spending for older people is anticipated to grow in the future, taking up a greater share of federal resources.”

Setting aside interest payments on the national debt, spending on seniors alone could soon approach 50% of all federal outlays, the CBO found.

While Medicare tends to attract the most attention in the senior housing and care space, Medicaid actually covers the majority of nursing-home residents in the United States — who, in 2018, accounted for about 15% of the total $50 billion spent on the federal level to support state Medicaid programs, according to the CBO.

One important caveat: The CBO estimates are based on current laws and spending trends, under which Medicare, Medicaid, and Social Security are mandatory costs that the federal government must fund. For instance, the CBO projects spending on Medicare and Social Security alone to jump from $1.3 trillion last year to $2.7 trillion in 2029, but that figure assumes that federal spending growth will accelerate over the coming 10 years.

But Medicaid in particular has faced multiple proposed funding cuts from Republican lawmakers in recent years, including a failed 2017 plan to convert the program to a block grant-based system that would have cut nearly $800 million in spending over a decade.

That effort failed as part of larger GOP attempts at repealing the Affordable Care Act, but recent reports have indicated that the Trump administration may be reviving the block grant plan.

Meanwhile, providers in a variety of states have found it difficult to survive on Medicaid reimbursements — which generally cover long-term nursing residents — even under current funding levels. Massachusetts nursing homes that primarily serve Medicaid beneficiaries, for instance, have an average operating margin in the red, with a local industry leader saying that a “colossal collapse” of the skilled nursing market in the state has already arrived.

While long-term care advocates have been vocal in their opposition to any cuts to spending on programs that serve elderly Americans, the CBO also painted those services as a net benefit for the overall society — and not just the burgeoning older baby boomer set.

“For example, such spending reduces the support that younger generations of people would otherwise provide to elderly friends and relatives. In addition, the expectation of future benefits from Social Security, Medicare, and other programs reduces the need for today’s non-elderly to privately save for their future living expenses and health needs,” the CBO observed. “To the extent that the relevant programs remain in place, younger generations will also benefit from those programs when they themselves are elderly.”