Investor sentiment on nursing care in the first half of 2018 held steady from the year-ago period, but the sector has potential for the future, according to commercial real estate services firm CBRE.

“As this segment goes through a much-needed transformation, long-term opportunity for yield is abundant,” the firm said in its Senior Housing & Care Investor Survey and Trends Report.

The survey was sent to more than 250 potential investors, with a focus on investment decision-makers specializing in the seniors housing and care space; there were 69 respondents. The responses came in June and included opinions from institutional investors, real estate investment trusts (REITs), developers, and private investors. These groups represented 62% of respondents to the survey.

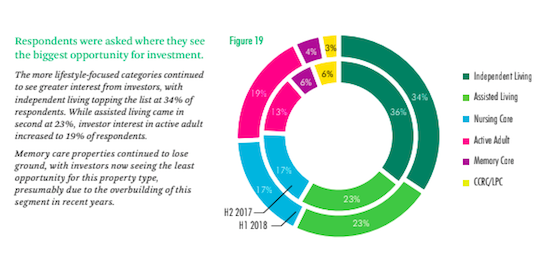

The respondents were asked which seniors housing and care segments presented the biggest opportunity for investment. The portion of investors who saw the largest opportunity in nursing care in the first half of this year stayed level with the first half of 2017, at 17%.

Independent living took the lead for senior housing segments, with 34% of investors saying they saw the biggest opportunity in this space. Assisted living came in second, with 23%, and only 4% of investors saw the biggest opportunity for investment in memory care.

The nursing care segment was down 44.5% in terms of transaction volume, the report noted, citing data from the National Investment Center for Seniors Housing & Care (NIC) for the second quarter of this year. NIC data from the first quarter found a similar decline in volume at 45%.

The second quarter decline in volume was mainly due to the changing regulatory environment and reimbursement uncertainty, CBRE said.

Written by Maggie Flynn