As Medicare Advantage continues to gobble up an increasing share of skilled nursing reimbursements, more providers are exploring the idea of launching their own plans — and while the numbers are small, the opportunity can be great.

Specifically, SNF providers can launch Institutional Special Needs Plans, or I-SNPs, a specific type of Medicare Advantage plan specifically geared at caring for nursing home residents.

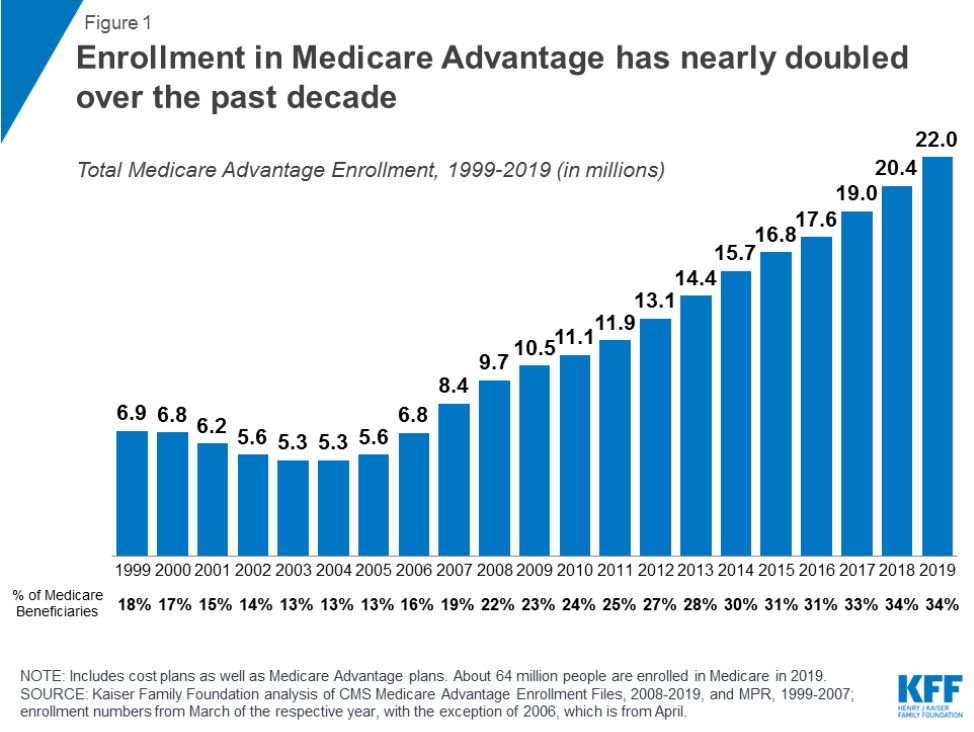

Granted, out of 22 million Medicare Advantage enrollees, there are just 3 million enrolled in Special-Needs Plans in general, Jennifer Boese, the director of health care policy at the accounting and advisory firm CLA said on a webinar held Tuesday. In addition to I-SNPs, that category includes other novel models for covering Medicare beneficiaries, such as D-SNPs for people with dual eligibility in Medicare and Medicaid.

But interest in the plans is growing, as is the number of enrollees.

It’s not just providers showing interest in MA and in SNPs; the Centers for Medicare & Medicaid Services (CMS) is very optimistic about MA, primarily indicated by the moves that the agency has made to try to give plans more room to experiment, Boese said. These include things like adding telehealth as a base benefit for MA and giving MA plans the capacity to expand supplemental benefits and look at social determinants of health.

These are not moves the government would be making without some confidence in the MA program, Boese argued.

“They’re not going to be moving towards more flexibility and more opportunities if they don’t think that it’s actually providing good care and at a good cost,” she said on the webinar.

Permanence as a SNP selling point

SNP enrollees, compared with MA beneficiaries as a whole, form relatively small numbers. But SNF providers have been driving growth in the number of MA SNPs enrolling institutionalized Medicare beneficiaries over the last two years, according to an analysis from Anne Tumlinson Innovations.

And as far back as March of last year, more and more members of the American Health Care Association (AHCA), a nursing home trade group, were expressing interest in I-SNPs, according to AHCA senior vice president David Giffords.

“We’re seeing more and more of our members pursue I-SNPs,” he said at a Politico Live event on in March 2018. “I think in general the [accountable care organizations] and the bundled payment models have been disappointing from the SNF side.”

Since then, provider interest may also have gotten a boost from legislation passed last year that gave SNPs permanent standing, Boese said on the Tuesday webinar.

“Probably part of the reason that SNPs have or are seeing growing interest and continue to increase in their numbers is because they were never permanent until 2018,” she noted. “And that was the Bipartisan Budget Act of 2018.”

Among other health care policies in that legislation were provisions that made SNPs permanent. The SNPS fall into three distinct categories: Institutional SNPs (I-SNPs), Chronic or Disabling Conditions SNPs (C-SNPs) and Dual-Eligible SNPs. Most SNP beneficiaries are in D-SNP plans, but the number of enrollees in I-SNPs is growing, Boese noted, citing data from the Kaiser Family Foundation.

By making SNPs permanent, she said, the Bipartisan Budget Act gave some certainty to anyone thinking about moving into the space.

“If I’m going to invest in all the capabilities and the financial and the capital of [becoming] a Medicare Advantage, a SNP — which means I’m going to become an insurer — I’m probably going to want to make sure that that opportunity is not going to go away,” Boese said on the webinar. “Which up until last year, there was arguably the possibilty for SNPs to go away. But now it is not so.”

Clinical and capital necessities

The cost of becoming an insurer is considerable, both from the perspective of costs and time, Boese noted. Significant capital is required, as is the development of a provider network, and the need to manage beneficiary enrollment.

In addition, SNPs — like other MA plans — receive per-member, per-month (PMPM) payments, and take on financial risk for coordinating and managing the care of those patients. That makes clinical capability another essential component of success in the world of SNPs, Boese stressed.

“You really need to have advanced, excellent clinical abilities to be in a SNP, because you’re managing individuals and sometimes some of those … these are more probably clinically complex enrollees,” she said. “And one of the requirements under the SNP is that you have what are called models of care (MOCs).”

These have 11 elements providers have to develop, including detailed information about the target population, measurable goals, staff structure and management roles, a provider network, and other key components. Providers use these elements to ensure they are providing the clinical best care to the enrollee population, while managing the financial side as well, Boese explained.

That might necessitate some hiring — for roles that are already in high demand in the SNF world, she noted.

“There’s different ways that a SNP can look at managing the care, but they have to be good at doing it,” she said. “Otherwise probably being a SNP is not going to be a successful venture for you, if you really aren’t able to provide this level of MOC requirements.”

‘The godfather’ of value-based payment

One thing providers working with -— and thinking about moving into — MA should remember is that CMS has been pushing the health care industry toward more value-based payments, and toward providers taking a financial stake in the health care they provide, Boese said.

“I’ve talked about MA as ‘the godfather’ of value-based payments,” she said, noting the pressure from CMS for providers and plans to be financially at risk if they don’t manage care well or pay too much — or both. “I kind of have viewed MA as a precursor to that, because of the capitated payment system.”

SNPs are one option among many for providers, and one that not all should necessarily consider, as experts noted at the AHCA conference and expo last year.

But if SNPs are the right fit, they could be attractive for providers looking to gain more control over their destiny.

“If you’re wanting to look and move into value-based care, if you’re wanting to get closer to the premium dollar so you’re not the one at the whim of the insurer or everyone else, but you’re the one controlling the dollar and the spend and the care … you’d be able to develop an approach that works best for you and for your enrollees,” Boese said.